|

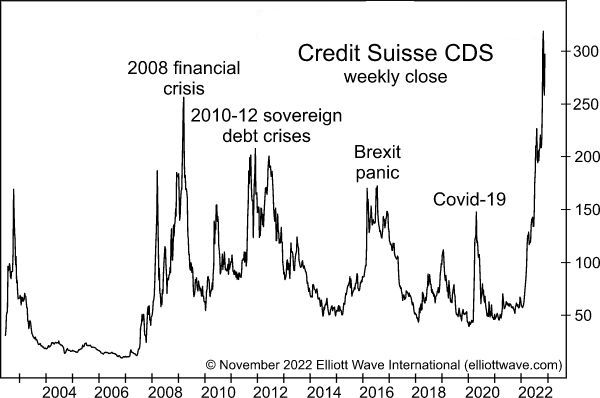

Credit Suisse: How the Price of Credit-Default Swaps Provided a Warning “… exceeded every high-water mark … of the past 15 years” Credit-default swaps were invented in the mid-1990s but a lot of people did not become aware of them until around 2000, and that awareness increased dramatically during the 2008 financial crisis. As you… Read more Credit Default Swaps Provide Warning |

Author:

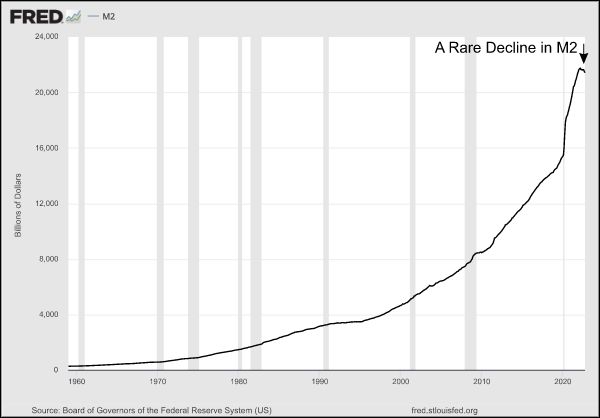

M2 Money Supply Deflates

|

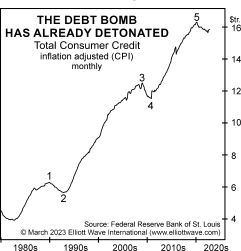

U.S. Money Supply Deflates 2% Annually (What That Means) The debt bomb implodes: Expect recession and deflation Many pundits have expressed worry about the ramifications of global debt — and rightly so. As the Wall Street Journal noted toward the end of 2022: The world has amassed $290 trillion of debt and it’s getting more… Read more M2 Money Supply Deflates |

Rise in Stock Market Volatility Ahead

|

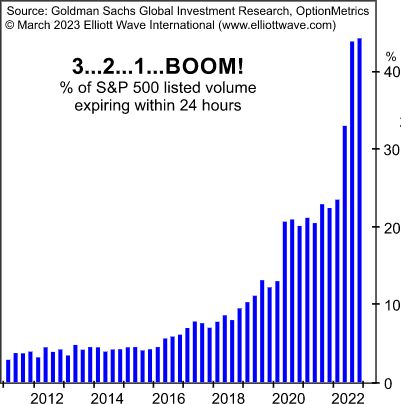

Explosive Rise in Stock Market Volatility! Why It May Be Ahead There are now S&P options that expire each day of the week. What that may mean. Here’s a Wall Street Journal headline from a couple of months ago that some people may have scanned without much contemplation (Jan. 11): VIX, Wall Street’s Fear Gauge,… Read more Rise in Stock Market Volatility Ahead |

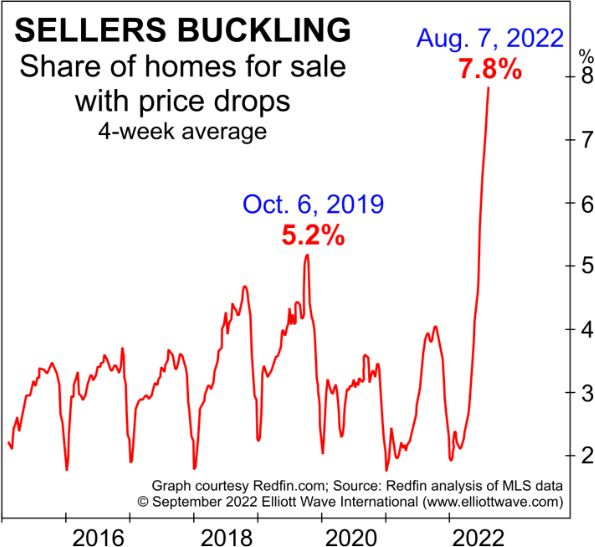

Housing Market Top

|

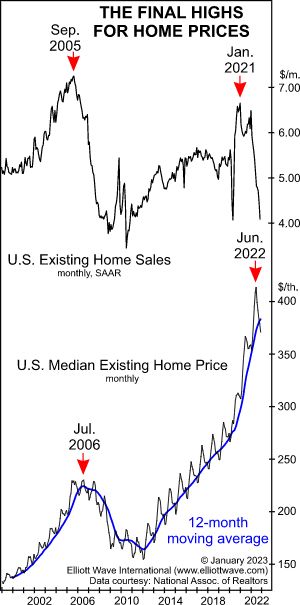

How This Pattern from the Prior Housing Bust is Repeating Here’s when homes will likely sell for once-in-a-lifetime bargains Just like the gold “in them thar hills” motivated people from all walks of life to become miners way back when, real estate booms have motivated people from far and wide to become agents. In both… Read more Housing Market Top |

Retail Investors Jump In

|

U.S. Stocks: Why Acting Independently Has Never Been More Important “Individual investors have been snapping up stocks at the fastest pace on record” More than 20 years ago, when I was working for another company, I remember hearing a colleague say that he doesn’t look at his monthly 401k statements. The implication was clear: He… Read more Retail Investors Jump In |

Recession Consensus Might Be Too Optimistic

|

Why the Recession Consensus Might Be Too Optimistic “Major stock market declines lead directly to…” The verdict seems to be in: The economy is headed for a recession. These headlines from the past few months show what I’m talking about: A 2023 recession would mean job losses for most industries … (USA Today, Feb. 3)… Read more Recession Consensus Might Be Too Optimistic |

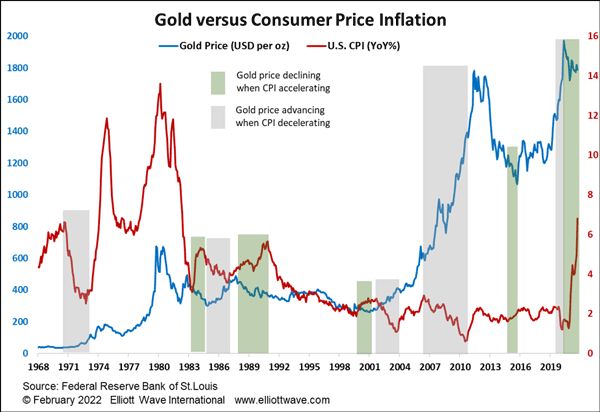

Gold Price and Inflation

|

Gold and Inflation: Here’s a Market Myth “If you believe in Gold as a consumer price inflation hedge then…” Back in the days of the Roman Empire, an ounce of gold could buy a Roman a well-made toga, belt and finely crafted sandals. In modern day Rome, lo and behold, a businessman can become sharply… Read more Gold Price and Inflation |

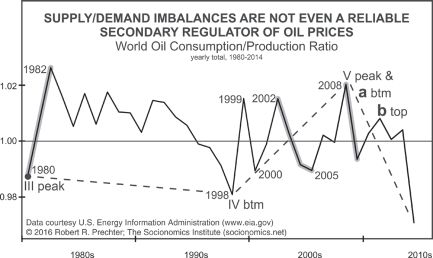

Why Oil Prices Fell Despite Supply Shock

|

Why Oil Prices Fell in the Face of “Supply Shock” “Crude should be at the forefront of a…” Looking back on 2022, one of the biggest fears about oil was that prices would skyrocket even more than they did due to a disruption in supply from Russia. Of course, Russia has been a major world… Read more Why Oil Prices Fell Despite Supply Shock |

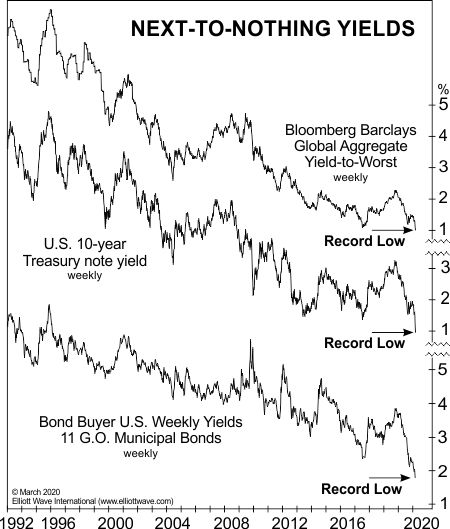

Deflation Threat

|

Why the Threat of Deflation is Real “The Federal Reserve is forging ahead with its balance sheet reduction” I know — inflation has been grabbing all the headlines for a good while now — so you may wonder why the subject of deflation is relevant. First, the definitions of inflation and deflation go beyond commonly… Read more Deflation Threat |

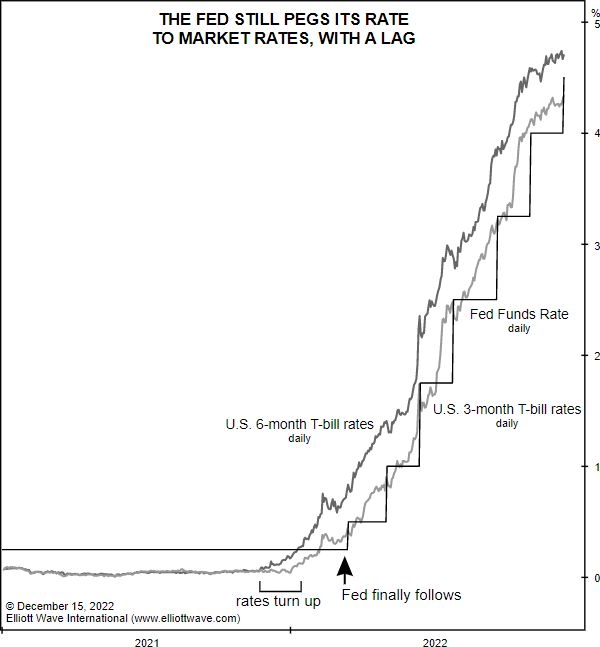

FED Follows Treasury Rates Again

|

Major Fed Myth: Debunked The Fed is reactive in setting rates – not proactive The days of near-zero interest rates are long gone — at least for now. As we look back on 2022, we know that it’s been a year of rising interest rates, and many observers say it’s all due to the Fed.… Read more FED Follows Treasury Rates Again |

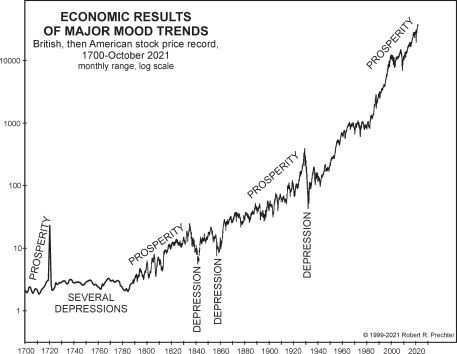

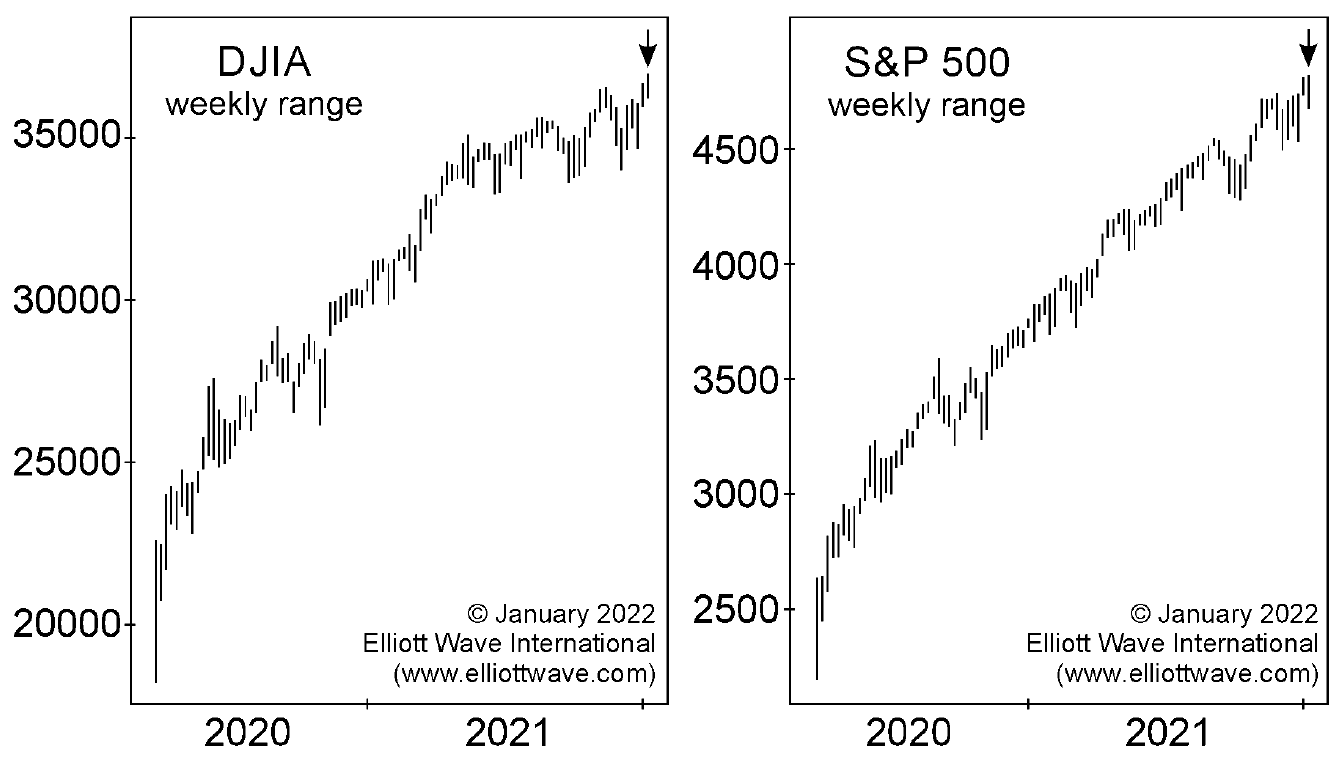

2022 May Have Been the Preview of the Upcoming Crash

|

Stocks and Economy: Why 2022 May Have Just Been the Preview “Fight the inertia that will keep you from taking action to prepare for the downturn” The main show is likely about to begin. 2022 may have just been a preview of what’s ahead for stocks and the economy, which Robert Prechter’s Last Chance to… Read more 2022 May Have Been the Preview of the Upcoming Crash |

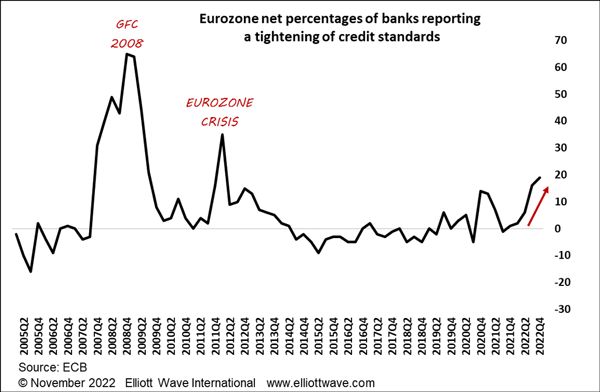

Tighter Lending Standards for Bank Loans

|

“Banks are becoming more cautious about lending” And the implications are bigger than just getting a loan Robert Prechter’s Last Chance to Conquer the Crash discusses the psychological aspect of a deflation: When the trend of social mood changes from optimism to pessimism, creditors, debtors, investors, producers and consumers all change their primary orientation from… Read more Tighter Lending Standards for Bank Loans |

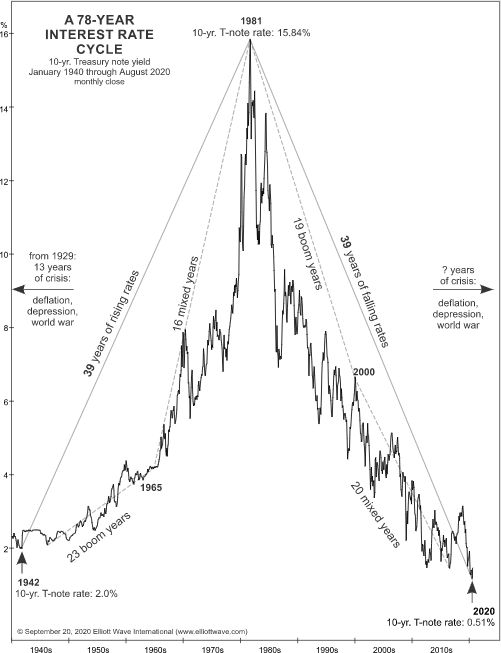

Investors in US Treasuries Face Major Risk

|

Why Investors in U.S. Treasuries Face Major Risk Rising rates will be “disastrous” for governments, other debtors and creditors The market for U.S. Treasuries is the biggest bond market in the world, and it appears that potentially big trouble may be afoot. Earlier this month, none other than the U.S. Treasury Secretary herself (Janet Yellen)… Read more Investors in US Treasuries Face Major Risk |

Real Estate Tide is Turning

|

THIS is Why the Real Estate Tide is Turning Here’s your next step to get a handle on the global property market. Treat houses as a consumption item — or simply as a place to live, and history shows that real prices will fluctuate only modestly over the decades. Treat houses as an investment, and… Read more Real Estate Tide is Turning |

Stocks and Bonds Can Fall in Tandem

|

Why You Should Be Leery of the 60 / 40 Portfolio “The tidal wave of risk assumption … may be turning” Many investors allocate a percentage of their portfolios to bonds to cushion against a drop in the stock market. A popular allocation is a 60 / 40 mix of stocks and bonds. However, this… Read more Stocks and Bonds Can Fall in Tandem |

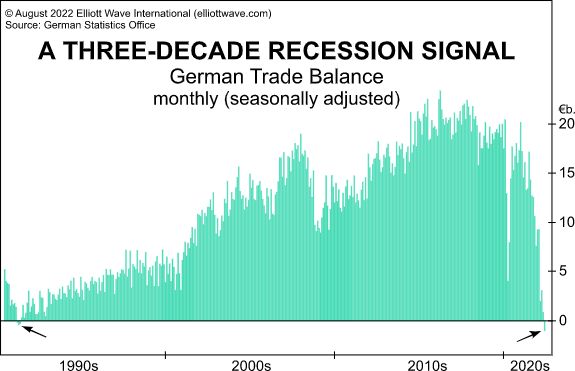

Will the Greatest Depression Start in Europe?

|

Will the “Greatest Depression” Start in Europe? This action by investors resulted in “the highest total since 2014, and probably ever” Many people are familiar with the Great Depression of the early 1930s, but most of them may not know that this economic calamity began in Europe before arriving in the U.S., as a past… Read more Will the Greatest Depression Start in Europe? |

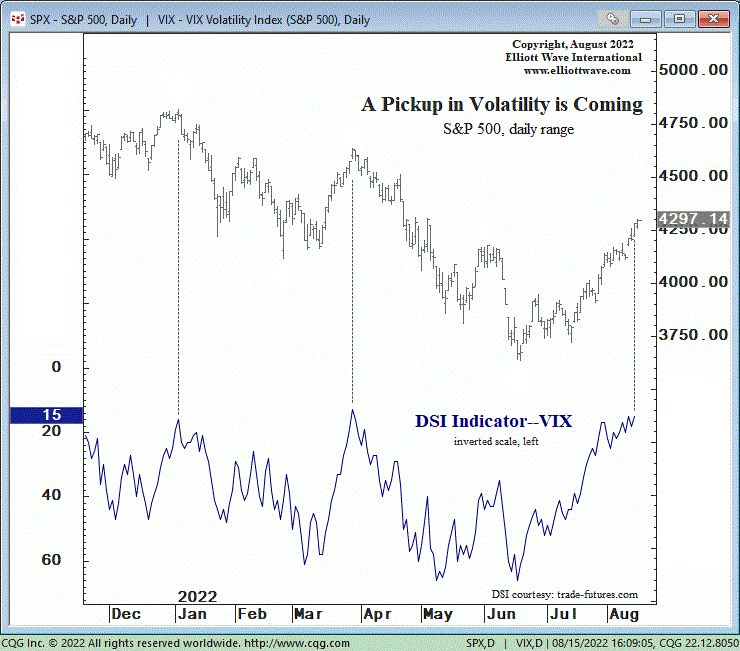

Daily Sentiment Index Extreme Says Volatility Is Next

|

Why You Should Expect a Pickup in Stock-Market Volatility “Traders are convinced the market volatility will remain subdued” When things get quiet in a horror movie, that’s when you need to really brace yourself. The monster or the killer will soon be on the scene. That’s a close enough analogy to what can happen in… Read more Daily Sentiment Index Extreme Says Volatility Is Next |

Only the Few Can Get Out at The Top

|

Severe Bear Market: Will You Be Among the Prepared 1.5%? “Oftentimes, rallies will end with an inter-index non-confirmation” A long-long time ago in a galaxy far away… errr, on the heels of the year 2000 dot-com crash, to be exact — which is ancient history for many investors today — the February 2003 Elliott Wave… Read more Only the Few Can Get Out at The Top |

Crypto Winter Update

|

Cryptos: Welcome to the “Lunatic Fringe” A crypto hedge fund going all the way down to $0 is one way you know it’s “a Grand Supercycle peak” The bankruptcy of crypto broker Voyager Digital has been widely reported. Now, another crypto investment “bites the dust.” This time — it’s Three Arrows Capital (3AC) — a… Read more Crypto Winter Update |

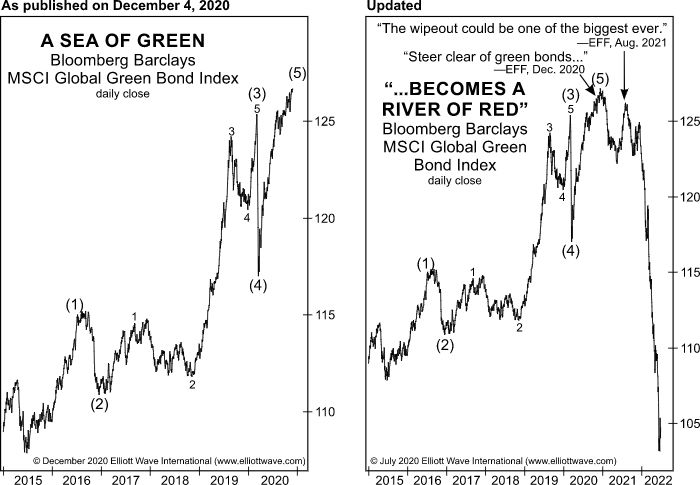

Wipeout of Green Bonds

|

Wipeout! New Update on Our “Green Bond” (ESG) Forecast Excessive euphoria in financial markets is usually a big reason to be “skeptical” Environmental, Social and Governance bonds (ESG) — also called “green” bonds — are offered by companies which want to advance the causes of social justice, social inclusion and green technology. This form of… Read more Wipeout of Green Bonds |