Kondratiev waves also called Supercycles, surges, long waves or K-waves are described as regular, sinusoidal-like cycles in the modern (capitalist) world economy. Averaging fifty and ranging from approximately forty to sixty years in length, the cycles consist of alternating periods between high sectoral growth and periods of relatively slow growth.

Nikolai Kondratieff (Kondratiev), a Russian economist was the first to suggest that industrial economies followed a cycle of change in prices and production. Actually, this cycle is a cycle of liquidity and not price. But rising and declining trends for money, labor and products are an effect of the cycle.

Kondratieff Cycle averaged 54 years in duration, however cyclic periods can expand and contract and are therefore inherently unreliable for precise timing. But the sequence of events in the Kondratieff Wave may be an immutable social process regardless of how many decades it takes it to play out. The presence of a credit inflating mechanism causes extreme booms and busts during the cycle.

As liquidity expands in the initial phase of the cycle, commodity prices rise reflecting the increasing business activity and inflation. As business activity and inflation accelerate, speculators bid up commodity prices due to their fear that inflation will continue to accelerate. After the rate of inflation peaks and starts to fall, the acceleration premium is removed from prices. Thus, commodity prices start to fall despite continued but slowing inflation, a trend called disinflation. At the same time, a change in psychology away from fear and toward feelings of relief and hope induces people to channel the excess purchasing media created during disinflation into bidding up the prices of investment assets such as stocks. Because inflation continues, the wholesale prices that manufacturers charge for finished products, the retail prices that stores charge for goods and the levels of wages that employers pay for labor all continue to rise but at a continously lesser rate, following the rising but slowing trend of business activity and inflation.

Near the end of the cycle, the rates of change in business activity and inflation flip to zero. When they fall below zero, deflation is in force. As liquidity contracts, commodity prices fall more rapidly, and prices for stocks, wages and wholesale and retail goods join in the decline. When deflation ends and prices reach bottom, the cycle begins again.

Other Explanations of Kondratieff Cycle

Early on, four schools of thought emerged as to why capitalist economies have these long waves. These schools of thought centered on innovations, capital investment, war and capitalist crisis. According to the innovation theory, these waves arise from the bunching of basic innovations that launch technological revolutions that in turn create leading industrial or commercial sectors. Kondratiev’s ideas were taken up by Joseph Schumpeter in the 1930s. The theory hypothesized the existence of very long-run macroeconomic and price cycles, originally estimated to last 50 to 54 years.

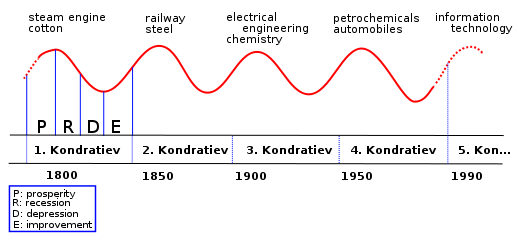

A rough schematic drawing showing the “World Economy” over time according to the Kondratiev theory. Since the inception of the theories, various studies have expanded the range of possible cycles, finding longer or shorter cycles in the data. The Marxist scholar Ernest Mandel revived interest in long wave theory with his 1964 essay predicting the end of the long boom after five years and in his Alfred Marshall lectures in 1979. However, in Mandel’s theory, there are no long “cycles”, only distinct epochs of faster and slower growth spanning 20 to 25 years. More recently, investment theorist Ian Gordon has advocated a 4 season Kondratiev model in which spring is moderate growth from a stock market and inflationary bottom, summer is characterized by accelerating growth and high inflation, autumn is characterized by declining inflation and asset bubbles, and winter involves the collapse of the asset bubbles.

Long wave theory is not accepted by most academic economists, but it is one of the bases of innovation-based, development, and evolutionary economics, i.e. the main heterodox stream in economics. Among economists who accept it, there has been no universal agreement about the start and the end years of particular waves. This points to another criticism of the theory: that it amounts to seeing patterns in a mass of statistics that aren’t really there.

Moreover, there is a lack of agreement over the cause of this phenomenon. How much this matters is disputed: some scientific patterns have in the past been identified before an explanation could be advanced. (The best known example is that of the precursors to the periodic table, which were in fact rejected by many scientists precisely on the grounds of lack of explanation.)

There is controversy over the validity of Kondratiev’s theory among many scholars. Some believe that not enough is attributed to actual human errors that have created some of the economic situations of history, and too much to the inevitability of the characteristics of the phases of the waves. They claim that many of the situations were entirely avoidable, not the consequences of an unstoppable wave pattern. Others doubt the legitimacy of Kondratiev’s waves because they believe that every wave is a structural cycle that has unique characteristics and cannot be repeated. There is also controversy over Kondratiev’s research. Many believe that the conclusions and results of his research are biased because he highlighted and used only certain events to reach his conclusions and left out other important data and events that could have affected his outcomes.

Most cycle theorists agree, however, with the “Schumpeter-Freeman-Perez” paradigm of five waves so far since the industrial revolution, and the sixth one to come. These five cycles are:

- The Industrial Revolution 1771

- The Age of Steam and Railways 1829

- The Age of Steel, Electricity and Heavy Engineering 1875

- The Age of Oil, the Automobile and Mass Production 1908

- The Age of Information and Telecommunications 1971

According to this theory, we are currently at the turning-point of the 5th Kondratiev. Some scholars, particularly Immanuel Wallerstein, argue that cycles of global war are tied to Capitalist Long Waves. Major, highly-destructive wars tend to begin just prior to an output upswing.

A specific modification of the theory of Kondratiev cycles was developed by Daniel Mihula. For the era of the modern society and capitalistic economy he defined 6 long economic waves (cycles) and each of them was initiated by a specific technological revolution:

- (1600-1780) The wave of the Financial-agricultural revolution

- (1780-1880) The wave of the Industrial revolution

- (1880-1940) The wave of the Technical revolution

- (1940-1985) The wave of the Scientific-technical revolution

- (1985-2015) The wave of the Information and telecommunications revolution

- (2015-2035?)The hypothetical wave of the post-informational technological revolution

Unlike original Kondratiev´s and Schumpeter´s views in Smihula´s conception each new wave (due to acceleration of scientific and technological progress) is shorter then a previous one. The main stress is put on technological progress and new technologies as decisive factors of any long-time economic development. Each of these waves has its innovation phase (there occur innovations in a form applicable in practical life and also their first real application) which is described as a technological revolution and an application phase in which the number of revolutionary innovations falls and attention focuses on exploiting and extending existing innovations. (As soon as an innovation or a chain of innovations becomes available, it becomes more efficient to invest in its adoption, extension and use than in creating new innovations.) Each wave (each cycle) of technological innovations can be characterized by the area in which the most revolutionary changes took place (leading sectors). Every wave of innovations lasts approximately until the profits from the new innovation or sector falls to the level of other, older, more traditional sectors. It is a situation when the new technology, which originally increased a capacity to utilize new sources from nature, reached its limits and it is not possible to overcome this limit without an application of another new technology. For the end of an application phase of any wave there are typical an economic crisis and stagnation . The crisis in 2007-2010 is a result of the coming end of the wave of the Information and telecommunications technological revolution.

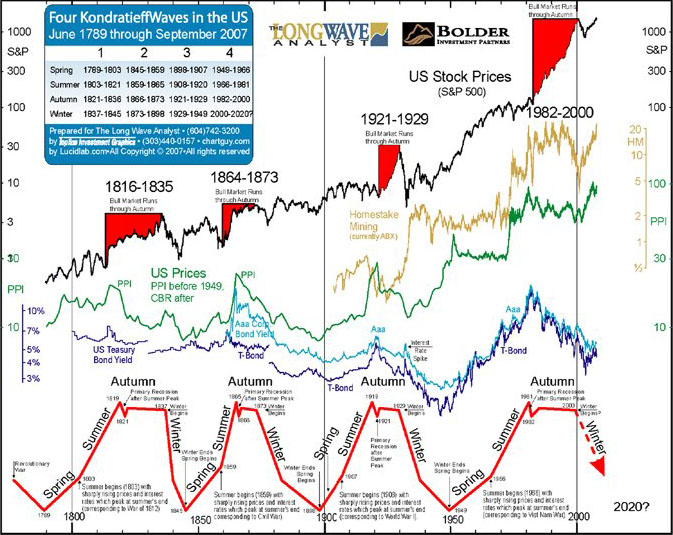

Here is a chart from http://www.thelongwaveanalyst.ca that maps the Kondratieff Wave periods along with US stocks market, US prices and T-Bond rates. According to this chart, Kondratieff Winter may last until around 2020.

According to the bible of deflation, Conquer the Crash, multiple degrees of Elliott Waves have topped around the year 200 but history shows that was only a wave 4 decline. The top in 2022 is one greater magnitude that rivals Great Depression and we are going into a crash that happens once in 400 years. This crash is the Kondratieff Winter.