|

Margin debt hits $1.13T — 20% above the 2021 peak! That’s euphoria in numbers. And it’s not the full story: hidden leverage is everywhere. Get free insights from @elliottwaveintl |

At the Peak

|

Market warning signs are popping up everywhere! Here’s another one that you can share with your audience. The chart below, Market Vane’s Bullish Consensus data, which tracks the buy and sell recommendations by analysts and commodity trading advisors. The current reading of 70 was exceeded only twice since 2010. December 2024 & January 2018 – both ahead of market peaks.… Read more At the Peak |

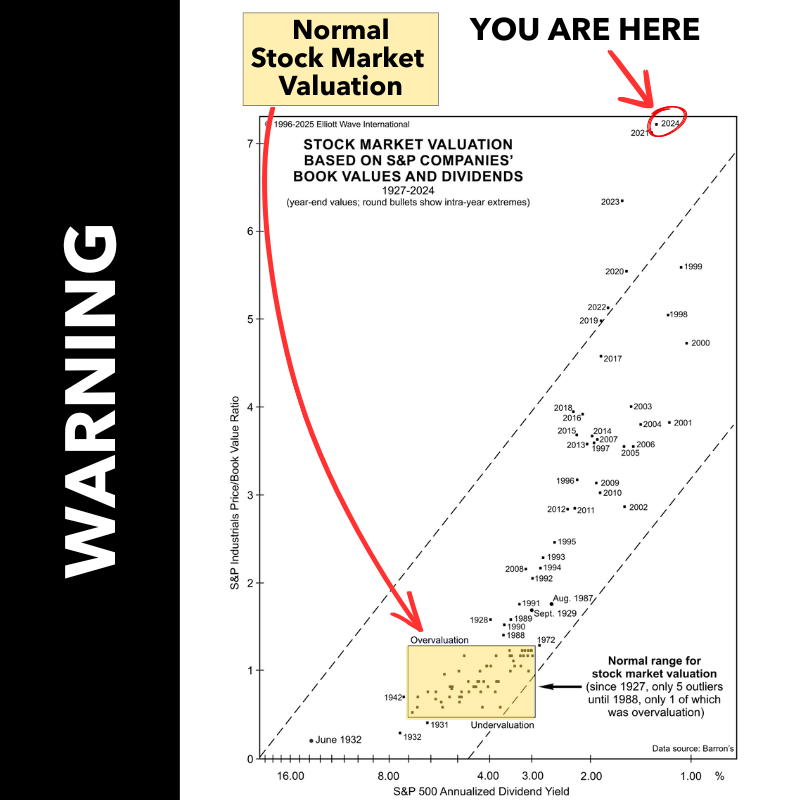

The Most Dangerous Market in History

|

A must-read report! 18 charts uncover just how stretched today’s investor optimism has become… and why it’s making today’s market the most dangerous in history. Check it out – free! Download now! Stocks don’t just look expensive… they’re off the charts. A ratio that’s now 4x higher than 2009’s low. In 2009, the Buffett… Read more The Most Dangerous Market in History |

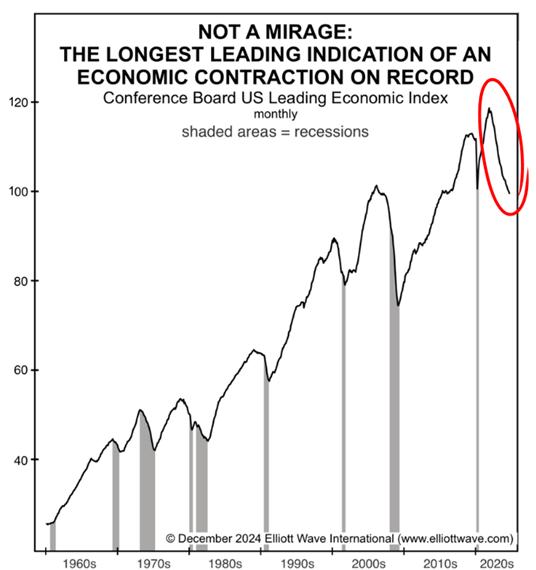

For Whom the Bell Tolls

|

Is the U.S. headed for a recession? In the history of the data back to 1959, there has never been a turndown of this magnitude without an ensuing recession. So what can you do NOW to prepare? Our friends at Elliott Wave International have put together a free report called “Preparing for Difficult Times.” It… Read more For Whom the Bell Tolls |

FED Follows the Market

|

Proof That the Fed Doesn’t Control Interest Rates Before every Fed meeting, investors and pundits wait in a state of high alert. Will the Fed raise rates? Cut them? Do nothing? They are wasting their time. The Fed doesn’t control interest rates; it’s the other way around. History shows that the T-bill market moves first… Read more FED Follows the Market |

Investors All-In on Stocks

That Can’t Happen in the USA?

|

That Can’t Happen in the US — Can It? Imagine the common stocks of residential real estate developers D.R. Horton or Lennar Corp dropping 98%. What would that imply for US real estate? Back in 2022, Elliott Wave International’s Global Market Perspective warned that China real estate developer Country Garden Holdings “is becoming a bellwether… Read more That Can’t Happen in the USA? |

Euro / USD Bottom was Predicted

|

EURUSD: What the News Reported After the Fact — and What Our Subscribers Knew in Advance By Elliott Wave International Over the past six months, major currency markets have seen some dramatic moves. Mainstream financial media has largely pointed to two key drivers: The 2024 U.S. presidential election The Federal Reserve These explanations may seem… Read more Euro / USD Bottom was Predicted |

Extremes at the Peak

|

‘Investors always want the most at the END of any advance’ On December 6, within two days of the Dow’s all-time high, the Elliott Wave Financial Forecast offered this unique insight: “Leverage is investors’ real-money way of expressing an extremely positive social mood, which prompts the thought, “I want more.” Investors always want the most… Read more Extremes at the Peak |

Tesla’s Troubles – Is it Musk or is it More?

|

Tesla’s Troubles — Is it Musk or is it More? Tesla tumbled 15% on March 10, its biggest single day drop in more than five years. Elliott Wave International’s March Global Market Perspective provides this insight: The world’s richest man, Elon Musk, is also more vulnerable than most people realize. In March 2023, when a… Read more Tesla’s Troubles – Is it Musk or is it More? |