Insights into This “Ultimate Harbinger” of the Bear Market

Enthusiasm for U.S. IPOs seems to be dramatically decreasing

Back in early 2021, many investors were chomping at the bits to invest in entities about which they knew next to nothing.

These entities are known as Special Purpose Acquisition Companies (SPACs), which may be described as shell companies which raise money through an initial public offering to acquire another company. Investors’ enthusiasm towards them has waned, but they are still around.

The amazing thing is that people who invest in SPACs don’t know the identity of the company to be acquired. Yet, they eagerly invest anyway.

It’s a reminder of Charles Mackay’s book, Extraordinary Popular Delusions and the Madness of Crowds, in which he described the extreme bullish sentiment way back in 1720:

“[A]n undertaking of great advantage came to market, but nobody is to know what it is.”

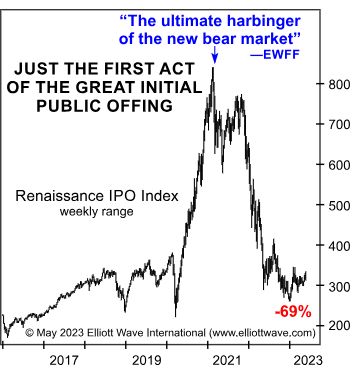

In March 2021, when several athlete- and celebrity-sponsored SPACs hit the market, the Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets, called it:

The ultimate harbinger of the next bear market.

Yes, the major stock indexes held up for another nine months or so — yet the IPO market had already started to show weakness.

Today, that weakness has morphed into an outright bear market. The June 2023 Elliott Wave Financial Forecast provides a review with this chart and commentary:

The chart shows the Renaissance IPO Index, which records the aftermarket performance of U.S. IPOs. The index peaked on February 16, 2021 and declined 69%. The total number of IPOs peaked a month later at 135, also an all-time high. For 2022 and the first four months of 2023, the average monthly total is only 15 U.S. IPOs.

As Barron’s stated back in March:

The Tech IPO Well Has Run Dry. It’s Likely to Stay That Way.

The diminishing number of IPOs is by no means the only warning sign for stock investors.

Elliott Wave International’s Financial Forecast Service discusses an array of indicators which may be of interest to you, as well as the message of the Elliott wave model.

An important point about the Elliott wave model is that it helps investors to identify turning points in the trends of financial markets.

Indeed, here’s a quote from Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior:

When after a while the apparent jumble gels into a clear picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%. It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so.

Here’s the good news: You can access the entire online version of the book for free once you become a member of Club EWI, the world’s largest Elliott wave educational community.

Club EWI is free to join without any obligations and members enjoy free access to Elliott wave resources on financial markets and investing, including exclusive articles and interviews with Elliott Wave International’s analysts.

Click on the link to get started right away: Elliott Wave Principle: Key to Market Behavior — get free and instant access.