|

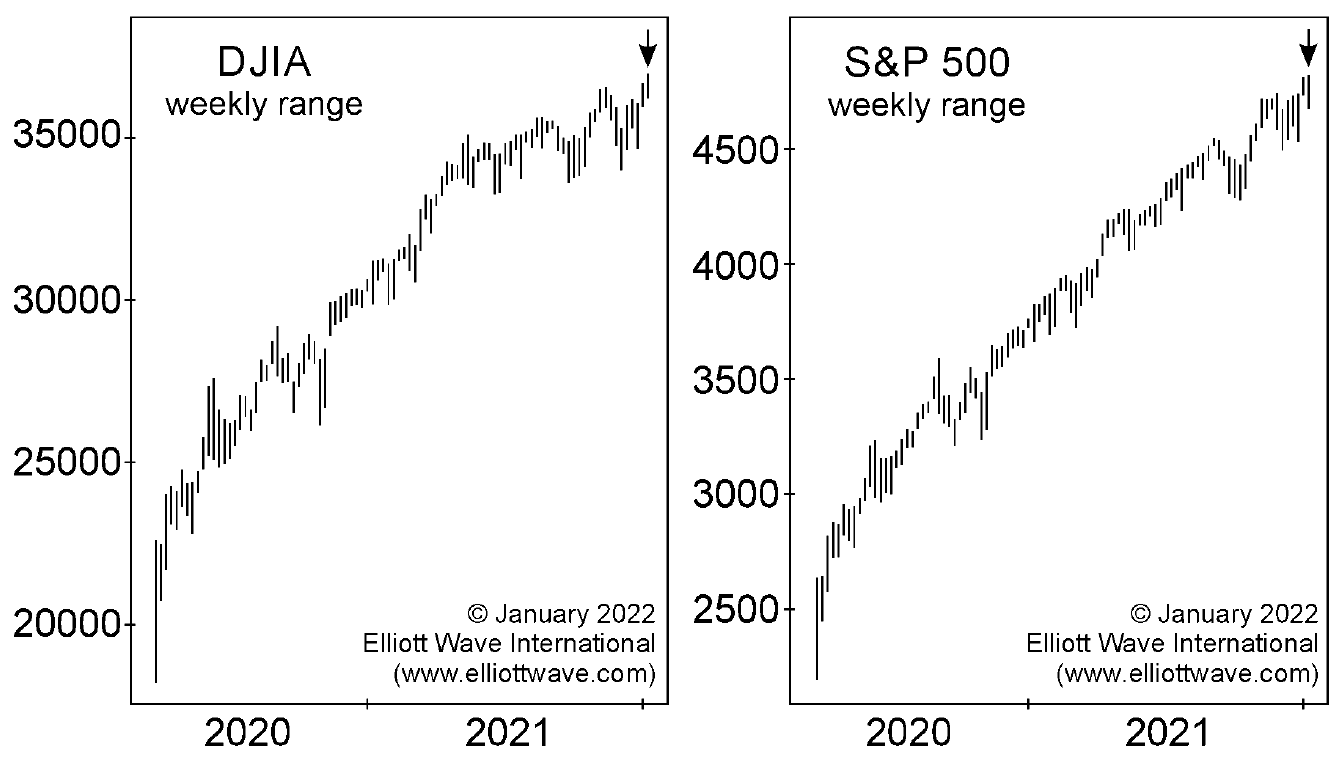

S&P 500: What to Make of Fear Versus Greed This sentiment index combines seven indicators into one useful trend measure That is — market participants generally go from feeling deeply pessimistic all the way to feeling highly optimistic — and then back again. These swings in investor psychology tend to produce similar circumstances at corresponding… Read more Extreme Greed in Stocks |

Category: Stock Market

Articles about stock market, market timing, technical indicators, stock market trends, market top, market bottom.

What the Fear Index VIX May be Saying

|

What “Fear Index” VIX May Be Signaling “Note the succession of higher closing low relative to higher highs in…” First, just a quick basic fact about the CBOE Volatility Index (VIX) — also known as the stock market’s “fear gauge”: the lower the reading, the higher the complacency among investors. Higher readings indicate increased investor… Read more What the Fear Index VIX May be Saying |

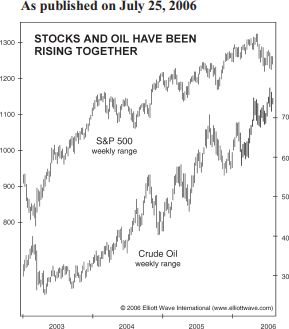

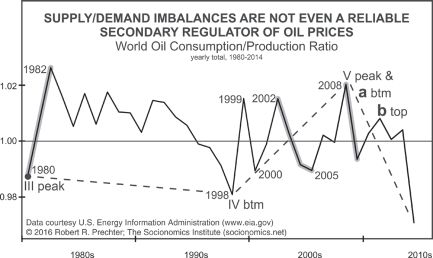

Climbing Oil Prices

|

“Climbing Oil Prices Bearish for Stocks”? It’s a Myth! Oil and stocks sometimes trend together. Other times, they don’t. There’s a widespread belief that rising oil prices are bearish for the main stock indexes and falling oil prices are bullish for stocks. That belief is reflected in this Sept. 5 CNBC headline: Dow closes nearly… Read more Climbing Oil Prices |

Why Do Traders Lose Money?

|

Why Do Traders Really Lose Money? Answer: It’s Not the Market’s Fault And 1 FREE course on how to help you stop self-sabotaging “good enough” trade plans I have always been a “who cares about the odds” kinda person. Meaning, if someone tells me the likelihood of succeeding at, say, learning to skateboard at 40,… Read more Why Do Traders Lose Money? |

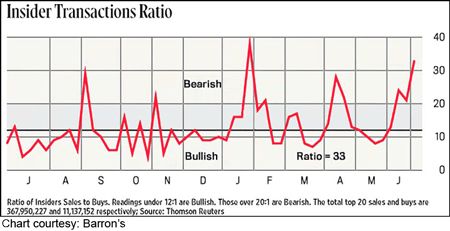

Insiders Selling

|

Pay Attention to This Group of Investors (They Know More) The stock market actions of corporate insiders is revealing It stands to reason that executives of a corporation know more about the goings-on of their business than outsiders. So, it’s wise to pay attention to their stock market actions regarding their own shares. Yes, the… Read more Insiders Selling |

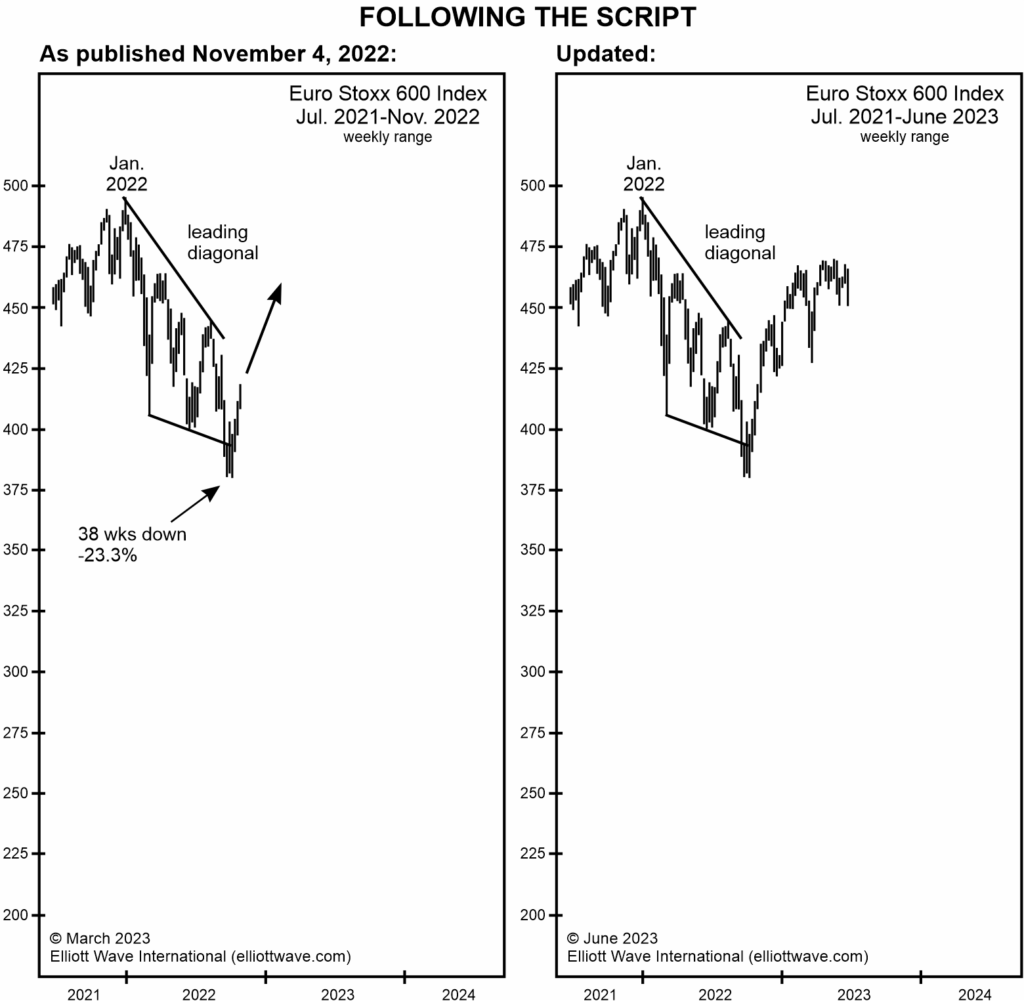

Euro Stoxx 600 Following the Script

|

Euro Stoxx 600: “Following the Script” “If the 2007 analogue holds, the current rally [will] persist …” On Oct. 24, 2022, Bloomberg said: Forget about a Santa rally to rescue European stocks from their doldrums, say strategists from Goldman Sachs Group Inc. to Bank of America Corp. A week and a half later, our November… Read more Euro Stoxx 600 Following the Script |

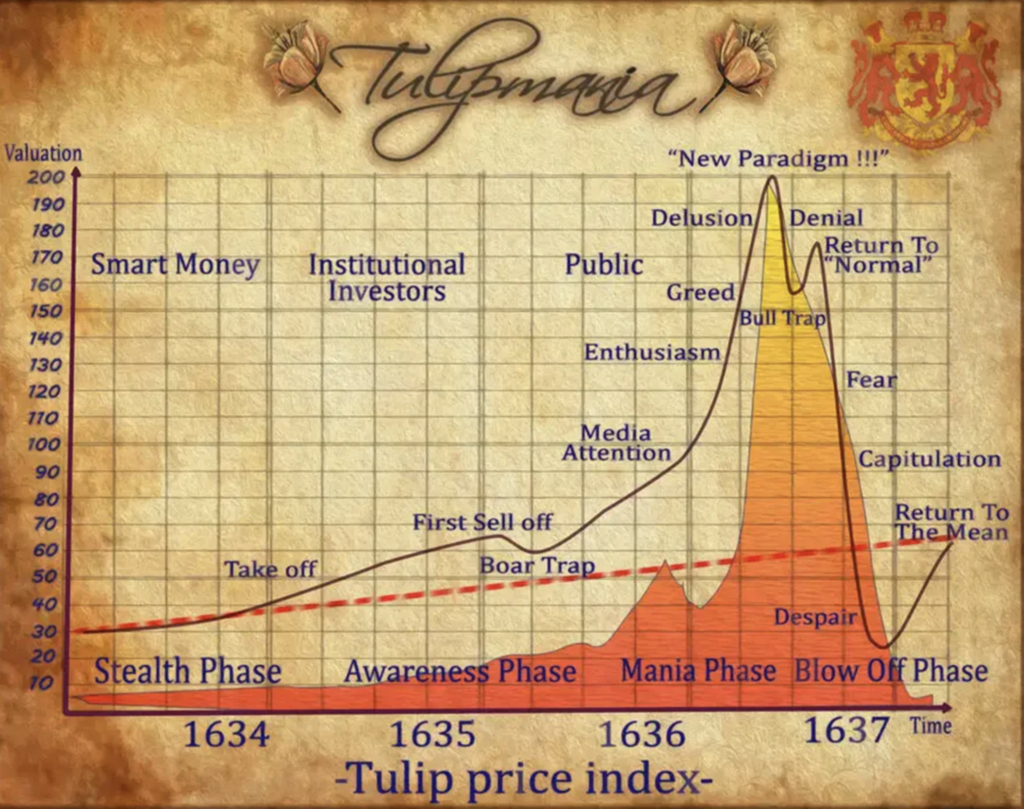

Tulip Mania Was Nothing

|

Recently, Elliott Wave International’s president Robert Prechter gave a rare interview. He covered a lot of ground – from stocks and Bitcoin to the economy and gold. Our friends at Elliott Wave International are sharing Prechter’s interview with you free. Listen as Prechter explains why 2021’s extreme market sentiment made the Tulip Mania look like… Read more Tulip Mania Was Nothing |

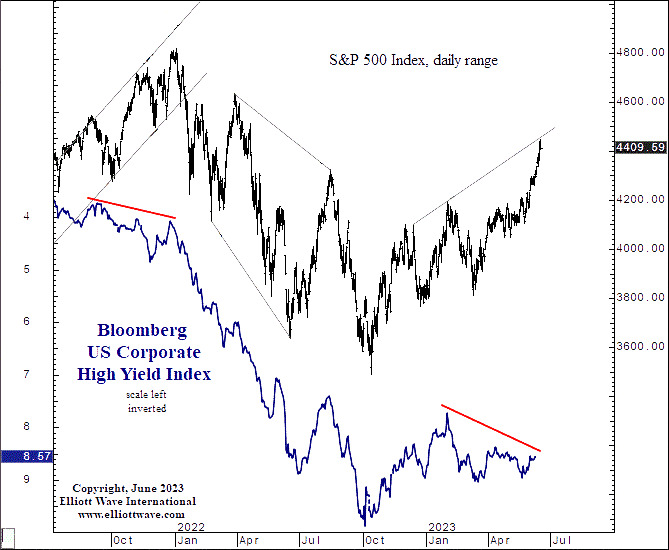

Divergence in Stocks vs Junk Bonds

|

Stocks and Junk Bonds: “This Divergence Appears Meaningful” “Everything was aligned until February 2” The trends of the junk bond and stock markets tend to be correlated. The reason why is that junk bonds and stocks are closely affiliated in the pecking order of creditors in case of default. The rank of junk bonds is… Read more Divergence in Stocks vs Junk Bonds |

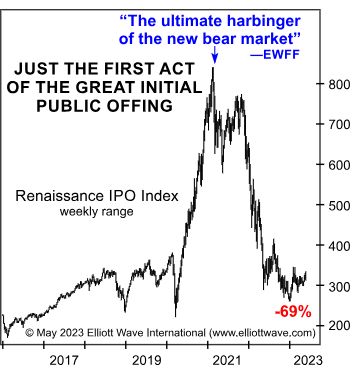

Harbinger of the Bear Market

|

Insights into This “Ultimate Harbinger” of the Bear Market Enthusiasm for U.S. IPOs seems to be dramatically decreasing Back in early 2021, many investors were chomping at the bits to invest in entities about which they knew next to nothing. These entities are known as Special Purpose Acquisition Companies (SPACs), which may be described as… Read more Harbinger of the Bear Market |

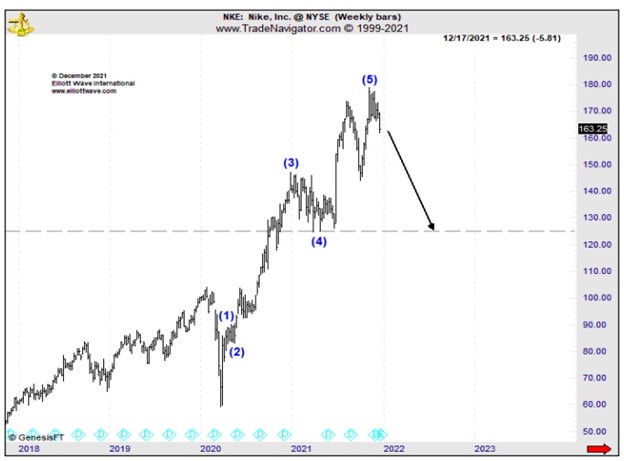

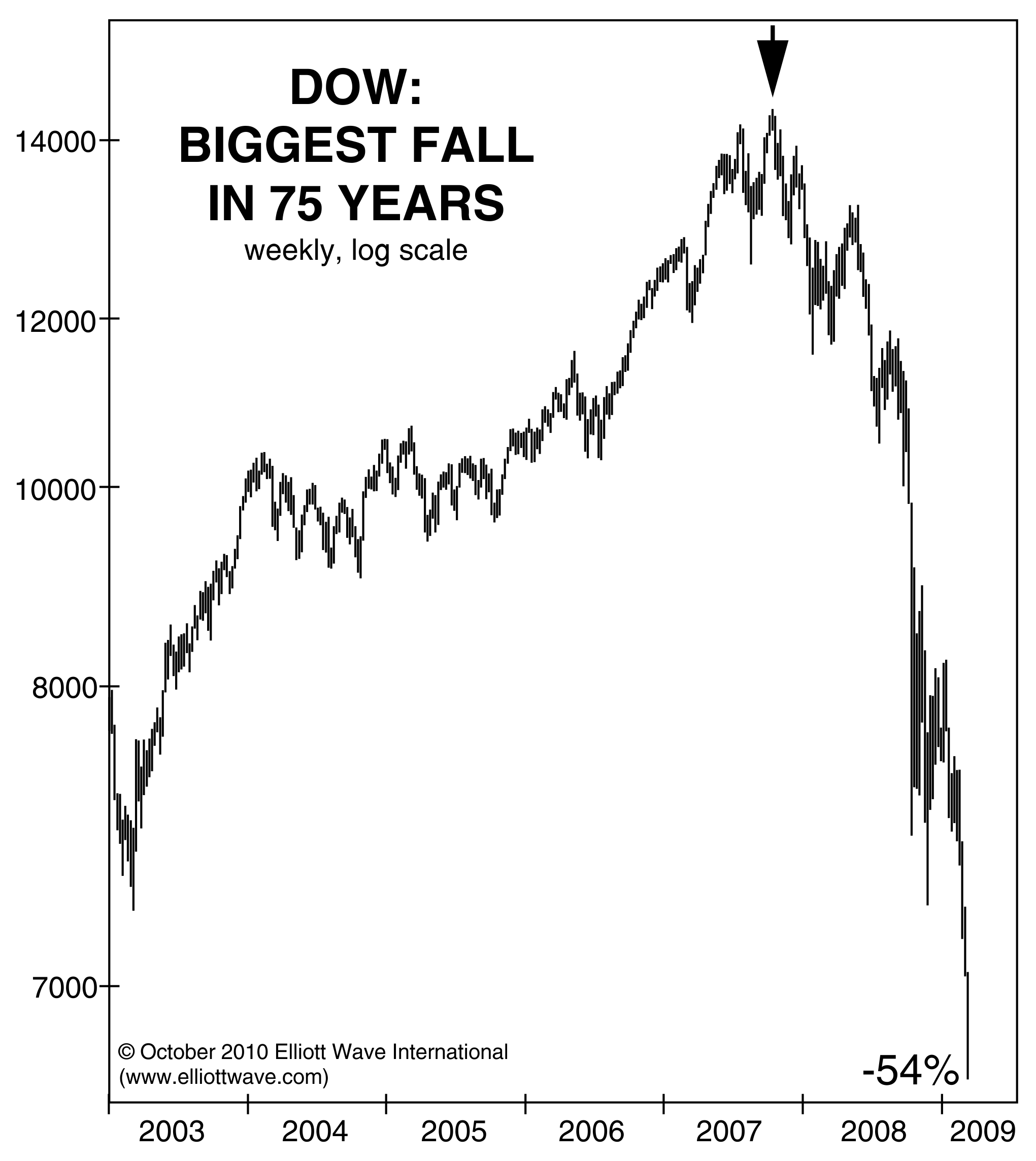

Possible Replay of History

|

Stocks: Possible Replay of an Ominous Price Pattern “I became panicky and covered at a considerable loss…” The reason price patterns tend to repeat in the stock market is that investor psychology never changes. The Elliott wave model directly reflects these largely predictable swings in investor psychology. That’s what the Elliott wave principle is all… Read more Possible Replay of History |

Sectors Leading Lower

|

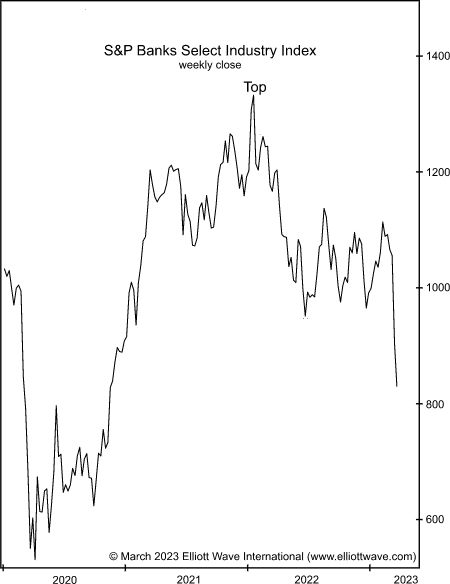

Will These 2 Sectors Lead the Stock Market Lower? This key sector continues to be “fragile” Although it doesn’t feel like it sometimes, the U.S. stock market has been in a downtrend since January 2022. The reason it doesn’t feel like it is because the S&P 500 has been in a narrow trading range between… Read more Sectors Leading Lower |

Insane Optimism in Stocks

|

How “Insane Optimism” is at Work in the Stock Market “Stock investors are so bullish that they are…” Many technical indicators are highly useful, yet the price moves of the stock market really boil down to two things: optimism and pessimism. Major trend turns tend to occur when extremes are reached in either optimism or… Read more Insane Optimism in Stocks |

Next Shoe to Drop: Corporate Bonds

|

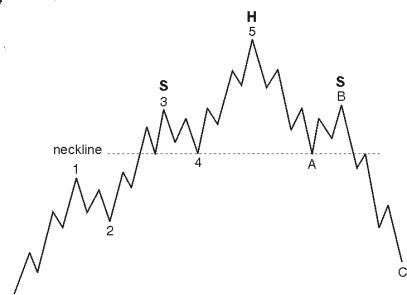

Corporate Bonds: “The Next Shoe to Drop” “The neckline has been broken over the last few days” A “calamity” is likely ahead for corporate bonds, says our head of global research, Murray Gunn. Some of Murray’s analysis involves the head and shoulders, a classic technical chart pattern. In case you’re unfamiliar with it, here’s an… Read more Next Shoe to Drop: Corporate Bonds |

Rise in Stock Market Volatility Ahead

|

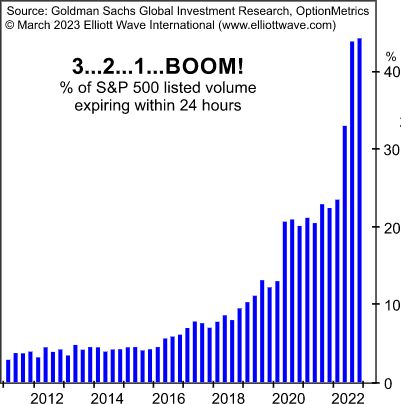

Explosive Rise in Stock Market Volatility! Why It May Be Ahead There are now S&P options that expire each day of the week. What that may mean. Here’s a Wall Street Journal headline from a couple of months ago that some people may have scanned without much contemplation (Jan. 11): VIX, Wall Street’s Fear Gauge,… Read more Rise in Stock Market Volatility Ahead |

Retail Investors Jump In

|

U.S. Stocks: Why Acting Independently Has Never Been More Important “Individual investors have been snapping up stocks at the fastest pace on record” More than 20 years ago, when I was working for another company, I remember hearing a colleague say that he doesn’t look at his monthly 401k statements. The implication was clear: He… Read more Retail Investors Jump In |

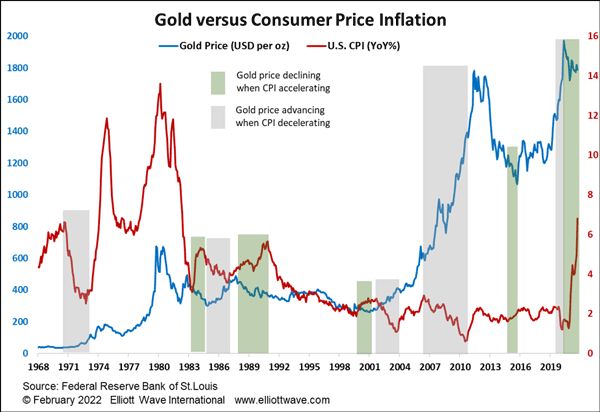

Gold Price and Inflation

|

Gold and Inflation: Here’s a Market Myth “If you believe in Gold as a consumer price inflation hedge then…” Back in the days of the Roman Empire, an ounce of gold could buy a Roman a well-made toga, belt and finely crafted sandals. In modern day Rome, lo and behold, a businessman can become sharply… Read more Gold Price and Inflation |

Why Oil Prices Fell Despite Supply Shock

|

Why Oil Prices Fell in the Face of “Supply Shock” “Crude should be at the forefront of a…” Looking back on 2022, one of the biggest fears about oil was that prices would skyrocket even more than they did due to a disruption in supply from Russia. Of course, Russia has been a major world… Read more Why Oil Prices Fell Despite Supply Shock |

2022 May Have Been the Preview of the Upcoming Crash

|

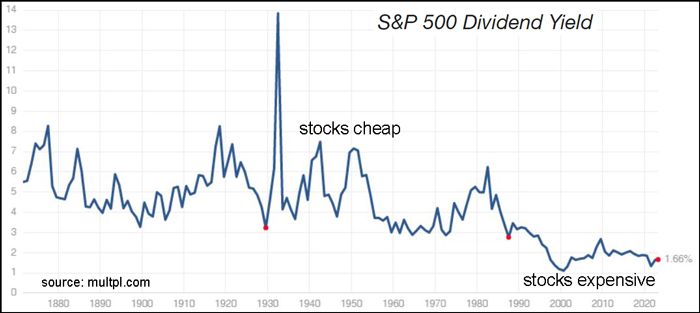

Stocks and Economy: Why 2022 May Have Just Been the Preview “Fight the inertia that will keep you from taking action to prepare for the downturn” The main show is likely about to begin. 2022 may have just been a preview of what’s ahead for stocks and the economy, which Robert Prechter’s Last Chance to… Read more 2022 May Have Been the Preview of the Upcoming Crash |

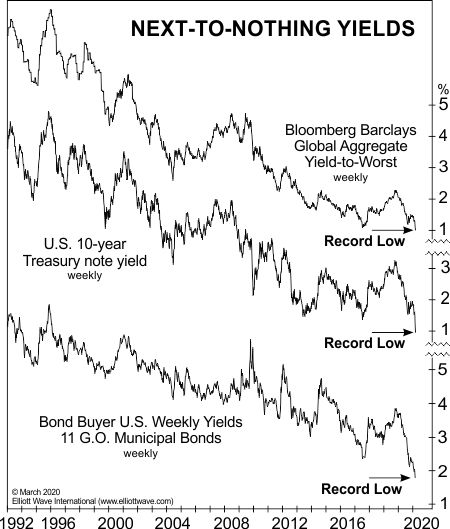

Stocks and Bonds Can Fall in Tandem

|

Why You Should Be Leery of the 60 / 40 Portfolio “The tidal wave of risk assumption … may be turning” Many investors allocate a percentage of their portfolios to bonds to cushion against a drop in the stock market. A popular allocation is a 60 / 40 mix of stocks and bonds. However, this… Read more Stocks and Bonds Can Fall in Tandem |

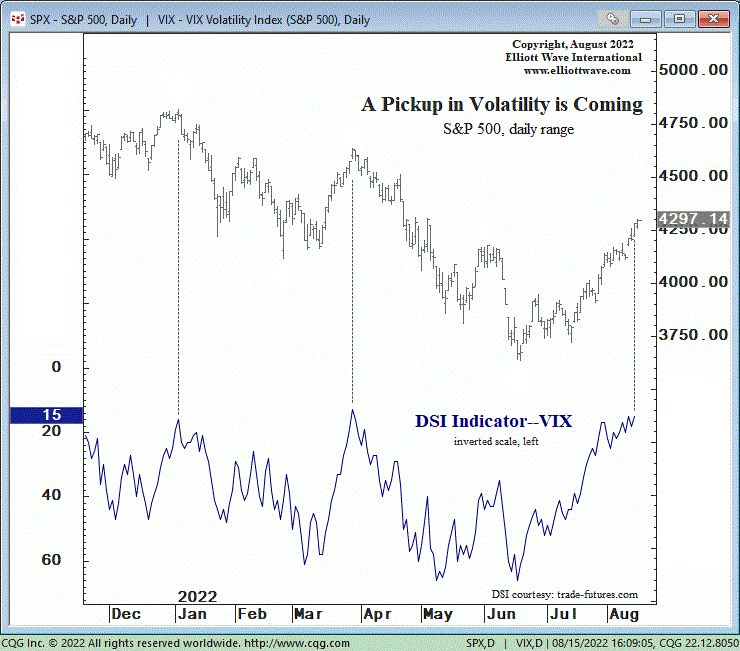

Daily Sentiment Index Extreme Says Volatility Is Next

|

Why You Should Expect a Pickup in Stock-Market Volatility “Traders are convinced the market volatility will remain subdued” When things get quiet in a horror movie, that’s when you need to really brace yourself. The monster or the killer will soon be on the scene. That’s a close enough analogy to what can happen in… Read more Daily Sentiment Index Extreme Says Volatility Is Next |