There is one solution to staying ahead of oil’s trend changes — Elliott wave analysis!

You know the expression “God works in mysterious ways”?

Well, according to an August 6 CNBC article, the price action of one financial market — i.e., crude oil — has out-mystified even God himself. Or, rather, the well-heeled star of the oil world, Andy Hall — a.k.a. “God Trader.”

According to CNBC, Hall’s oil-focused commodity hedge fund plunged 17% in July, its second-biggest monthly loss ever. And one that left the fund “$500 million poorer.”

In a letter to investors, Hall admitted failing “to anticipate a sudden market shift that roiled crude,” and wrote:

“Last month was brutal for most commodities and anyone investing in them.”

No argument here: July was a “brutal” month, as crude oil prices crashed 21% for their biggest monthly decline since the 2008 financial crisis.

And, yes — many oil experts (despite their God-like reputations) failed to anticipate the roiling “market shift.” The reason why they failed to see it coming, though, may surprise you.

Here’s the thing: From its March 2015 low to June high, oil prices had soared 40%-plus to enjoy their strongest rally in six years. Not to mention a positive fundamental backdrop including strong demand and escalated violence in the Middle East, led by protests in Libya and conflict in Yemen.

From a mainstream perspective, oil’s downside looked overdone, as this bullish May 6 news source affirms:

“Global demand continues to surprise to the upside with data showing no signs of slowdown despite a pick-up in prices… Bulls are in control of the market.” (Reuters)

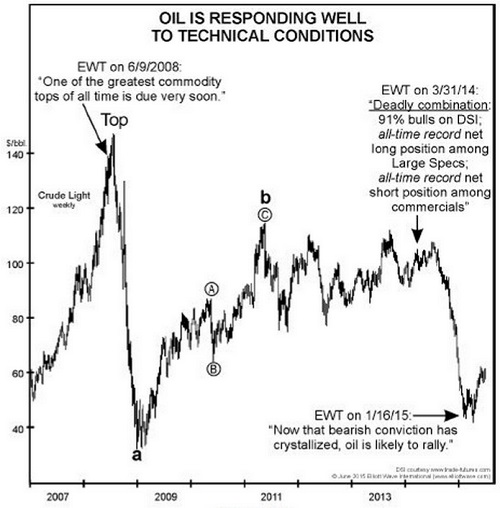

Looking at that bullish backdrop of “market fundamentals,” there was simply no way to have foreseen the opposite scenario — namely, oil’s imminent reversal. From the viewpoint of Elliott wave analysis, however, oil’s reversal was quite plain to see. In fact, our June 2015 Elliott Wave Theorist set the stage for just such a move:

“The price of oil has been stunningly volatile, but — unlike the stock market — it has consistently responded to our wave interpretations and extremes of sentiment…

“Figure 14 marks our predictions and updates prices. On a near term basis, the latest rally is now nearly the size of the rally of early 2014. The ‘No Bottom in Sight’ articles have stopped appearing, and the Daily Sentiment Index (courtesy trade-futures.com) has hit 86%. The rally should be about over.”

Let’s be honest. We’re all human. There’s no such thing as omnipotence in the world of trading or market-forecasting. Elliott wave analysis is not about 100% certainties. But it is about identifying the most likely turning points in advance — not by reading the news, but by reading the Elliott wave patterns unfolding on the price charts themselves.

In a new FREE report titled “Peak Oil — and Other Ways Crude Oil Fooled Almost Everyone,” we show you how Elliott wave analysis has remained one step ahead of not just the July sell-off, but the major peaks and lows that have occurred since oil’s all-time 2008 high near $150 a barrel.

This article was syndicated by Elliott Wave International and was originally published under the headline Crude Oil Works In Mysterious Ways. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.