|

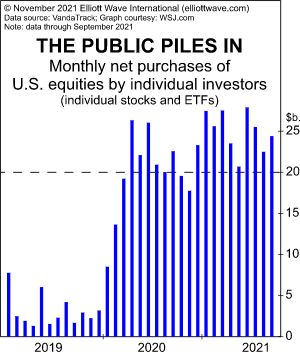

New Update on the Public’s Voracious Appetite for Stocks Here’s a month-to-month breakdown of how much money individuals are spending on stocks. It’s been noted before in these pages that … … Investors have put more money into stocks in the last 5 months than the previous 12 years combined That was an April CNBC… Read more Public is all in Stocks |

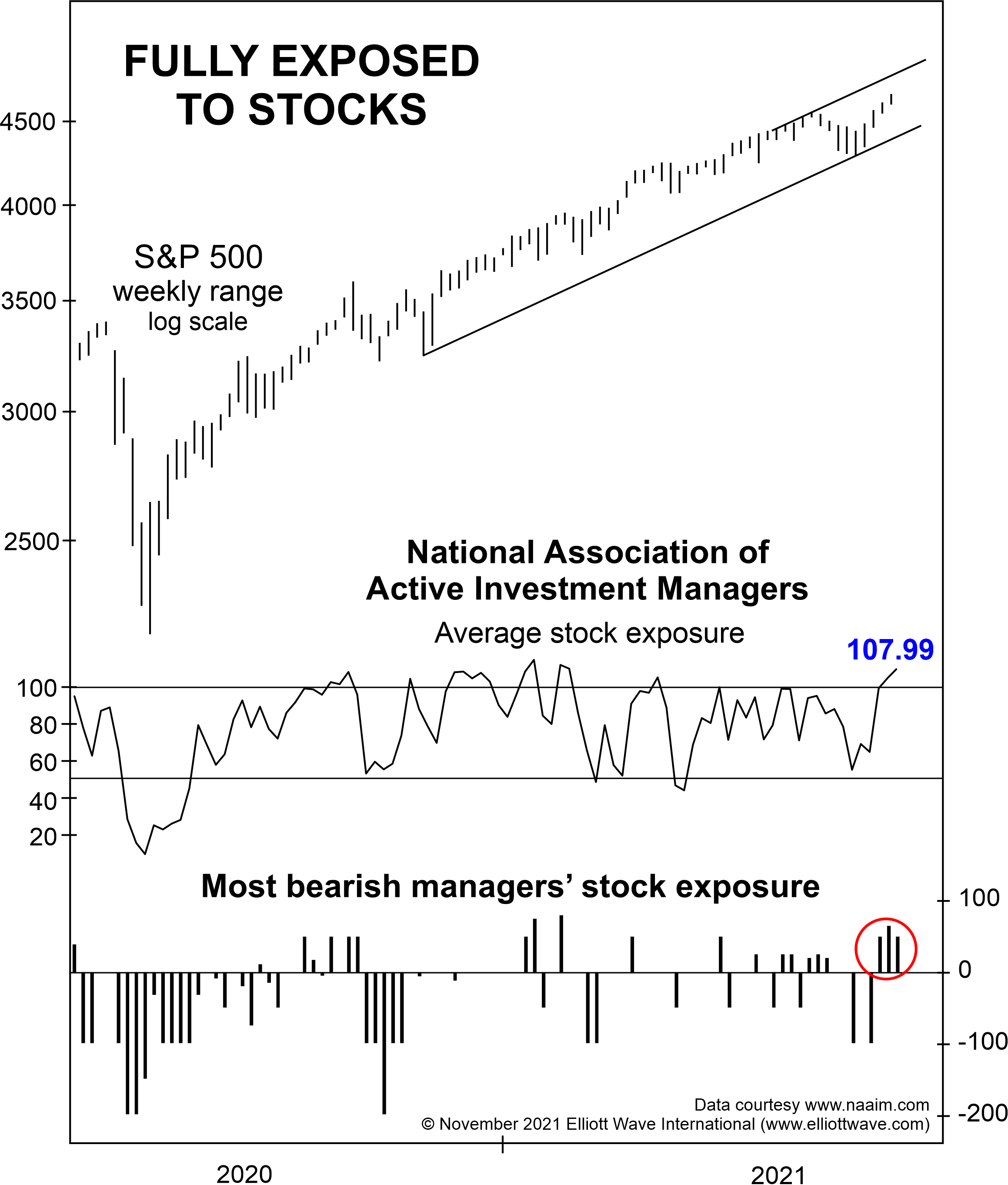

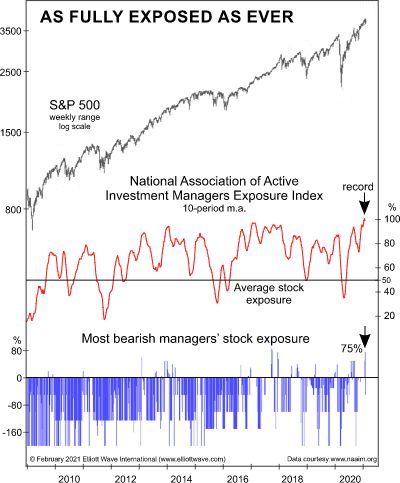

Even the Bears are Bulls Now

|

When Even Bears Act Bullishly (What It May Mean) “Some indicators are making records” It’s difficult for most investors to take an independent stand from the crowd. For example, it may be wise to “buy when there’s blood in the streets,” as Baron Rothschild famously said, but for many investors, that’s easier said than done.… Read more Even the Bears are Bulls Now |

Free WEEK

|

You may agree that today, “hopeful” describes how most investors feel. Everyone is invested to the last penny! Hopeful that the pandemic will finally go away. Hopeful that Washington will do more good than harm. Hopeful that inflation will fall, and employment will rise. And, hopeful that stocks will keep rising if investors get their… Read more Free WEEK |

Kiss of Death

|

Stocks: Is This the “Kiss of Death” for the Bull Market? Stock market prices usually decline after this occurs. Many market observers believe that the catalyst for the next bear market will be a piece of extraordinarily bad news. However, Elliott Wave International has shown time and again that the stock market’s price action is… Read more Kiss of Death |

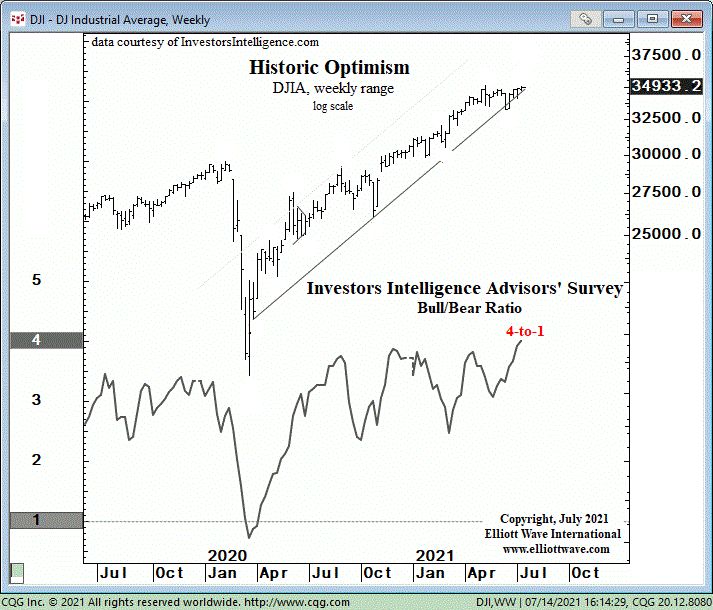

Record Optimism

|

January 27, 2022 Update M&As: Beware of This Major Sign of a Stock Market Top Here’s what often precedes “prolonged and devastating bear markets” Inside the three publications that comprise Elliott Wave International’s flagship Financial Forecast Service, Elliott Wave International recently documented the many expressions of “financial optimism.” Things like crypto mania. Or meme stocks.… Read more Record Optimism |

Bull Market Coverage is Bearish

|

Advance warnings about the recent crypto crash were there all along. How did almost everyone miss them? Anyone on Planet Earth in 2021 knows about the rise and fall of digital currencies. Even many kids are aware. But what has baffled just about everyone is what’s BEHIND the moves. This was made especially clear by… Read more Bull Market Coverage is Bearish |

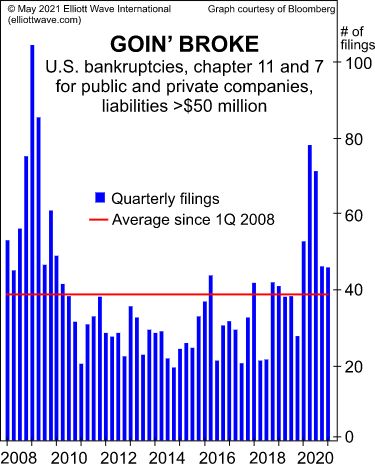

Corporate Bankruptcies

|

Why U.S. Corporate Bankruptcies Could Skyrocket “U.S. bankruptcies in the first quarter of 2021 and all of 2020 were above the 13-year average” An April 17 article headline on the website of National Public Radio says: U.S Economy Looking Good As Spending Jumps In March And, on April 29, The New York Times said: Americans’… Read more Corporate Bankruptcies |

The Peak in World Stocks

|

“Wall Street never changes,” said Jesse Livermore, the legendary ‘boy plunger’ trader. “The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes.” Livermore’s trading life started towards the end of the 1800s, just as Charles Dow was writing about the stock market in his Wall Street Journal. Dow’s… Read more The Peak in World Stocks |

Russell Index and the Meme Stocks

|

Why This Stock Market Index May Be Headed for a “Bumpy Ride” On Friday, June 25, the Russell indexes underwent their annual rebalancing. In other words, stocks were moved from the Russell indexes like the Russell 2000 and Russell 1000 based on their size. This event usually coincides with a big jump in trading volume… Read more Russell Index and the Meme Stocks |

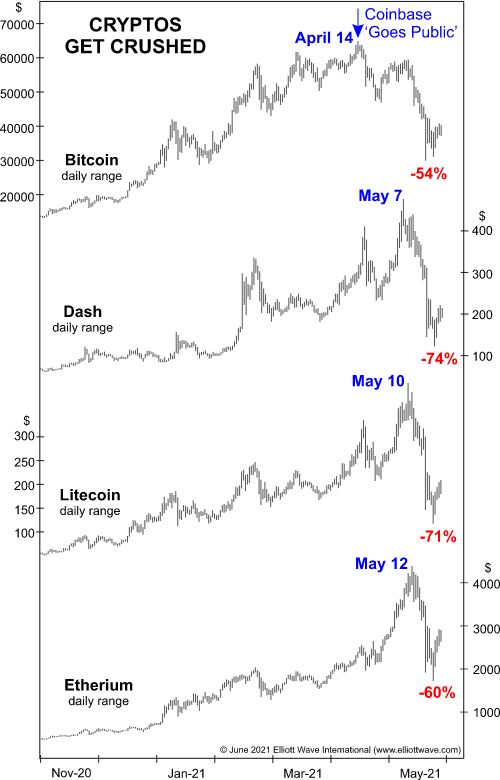

Crowded Crypto Trade Ending Badly

|

Bitcoin: “Crowded Trades” Can End Badly. Here’s How to Spot One. Cryptos can hugely reward, yet just as swiftly — punish. The phrase “bank run” tends to conjure up images of the 1930’s Great Depression. However, that phrase is now applicable to the 2021 world of cryptos. This is from a June 17 coindesk.com article:… Read more Crowded Crypto Trade Ending Badly |

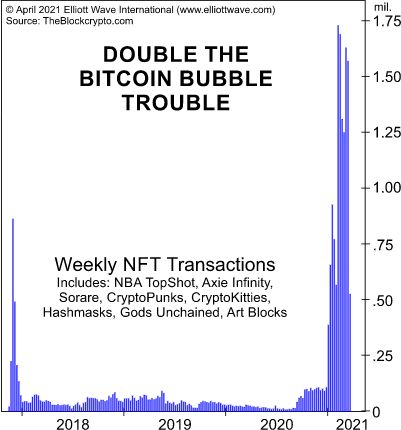

Non-Fungible Tokens Mania

|

Cryptos: What the “Bizarre” World of Non-Fungible Tokens May Be Signaling The world of cryptos includes something known as non-fungible tokens, which go by the acronym NFTs. If you’re unfamiliar with them, they’re a bit bizarre but quite simple. Here’s what the April Global Market Perspective, a monthly Elliott Wave International publication which covers 50+… Read more Non-Fungible Tokens Mania |

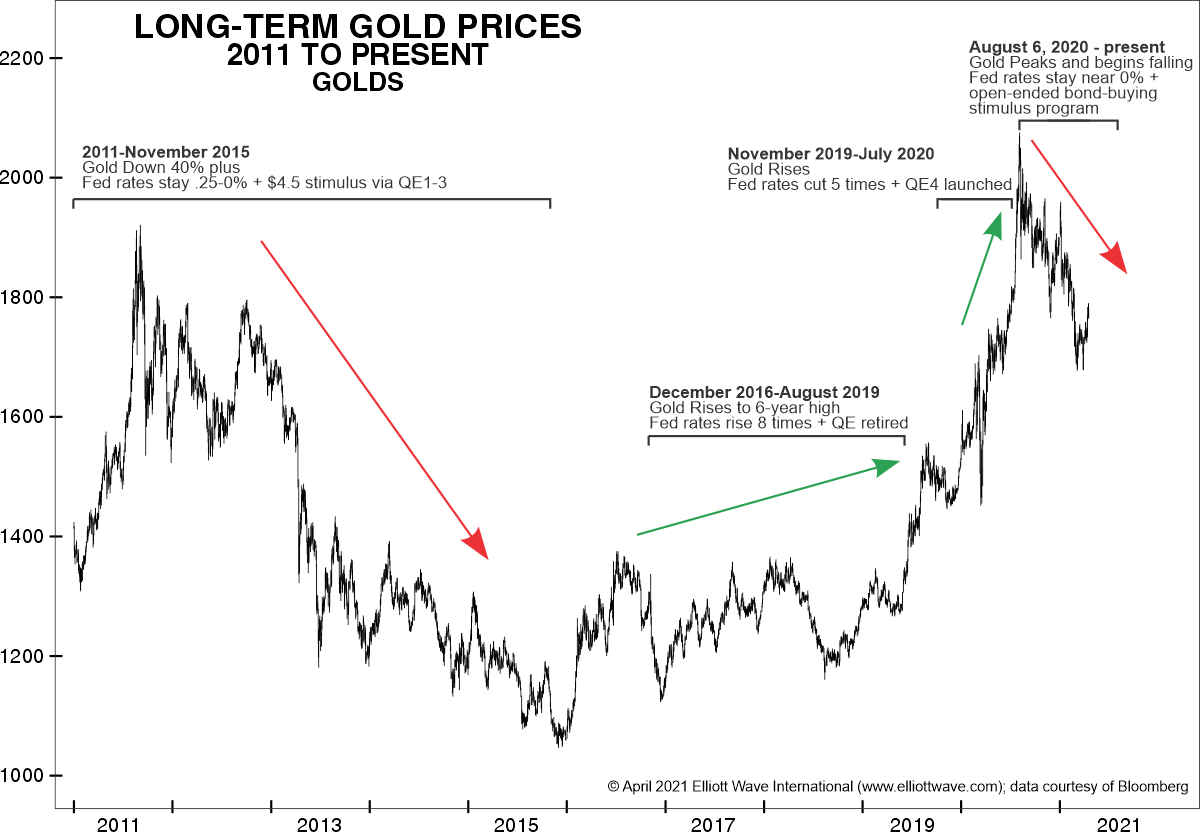

Does Gold Go Up Due to Money Printing?

|

What Drives Gold Prices? (Don’t Say “the Fed!”) Excerpted from Elliott Wave International’s new FREE report ” Gold Investor’s Survival Guide: 5 Principles That Help You Stay Ahead of Price Turns.” There is a glaring hole in the popular understanding of what drives gold’s price. Mainstream finance believes the Federal Reserve’s monetary and interest rate… Read more Does Gold Go Up Due to Money Printing? |

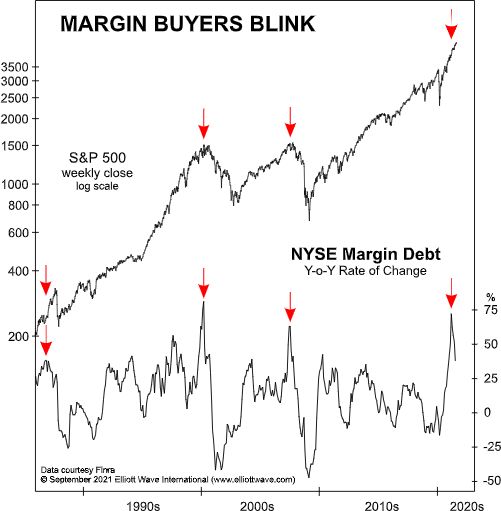

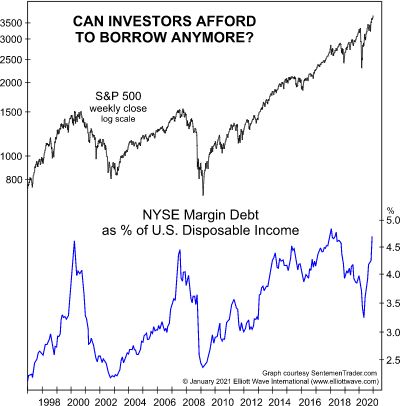

The Margin Doom

|

“Fastest Jump Since 2007”: How Leveraged Investors are Courting “Doom” “Our view is that the use of margin to buy stocks is far higher than the NYSE figures indicate” The stock market uptrend has extended for more than 11 years. Even so, instead of displaying caution, investors have been borrowing to buy stocks like there’s… Read more The Margin Doom |

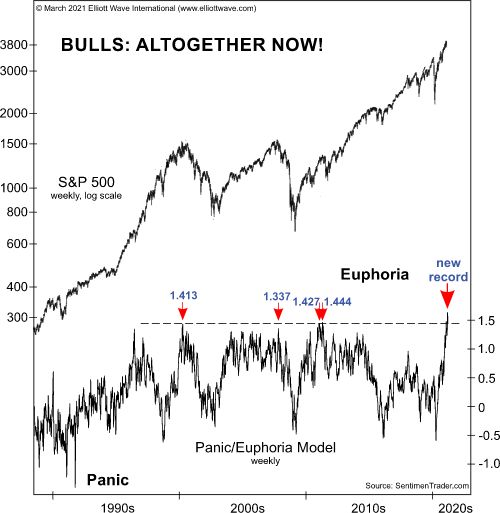

Panic and Euphoria

|

8 Indicators in 1: Here’s the Message of the Panic/Euphoria Mode. Prior model extremes occurred in March 2000 and October 2007. Elliott Wave International has been providing market analysis for more than four decades — which includes many bull/bear market cycles. That said, the public’s current market mindset — especially among inexperienced investors — is… Read more Panic and Euphoria |

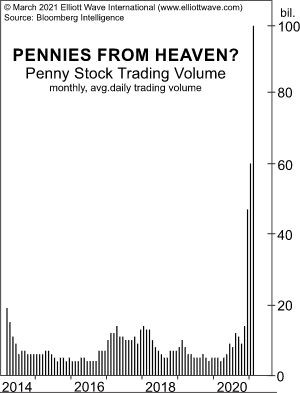

Road to Riches via Penny Stocks?

|

Penny Stocks Hit $2 Trillion Penny stocks are an investment vehicle that really has garnered the attention and speculation of investors in early 2021. They’re plunging headlong into off-exchange shares. I remember back when I started in the early 1980s at Merrill Lynch, there was a guy that walked in the office and he had… Read more Road to Riches via Penny Stocks? |

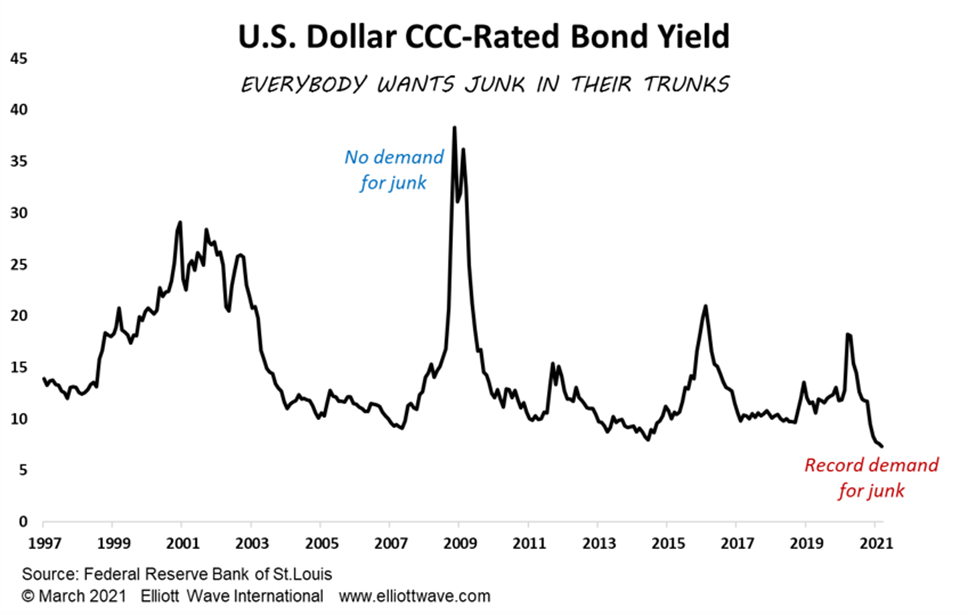

Record High Junk Bond Demand

|

If raising money doesn’t get any easier than this, what’s next? The latest data from Refinitiv shows that companies have raised a record $140 billion in the U.S. dollar junk bond market during the first quarter of this year. That beats the previous record set during the second quarter last year when companies scrambled to… Read more Record High Junk Bond Demand |

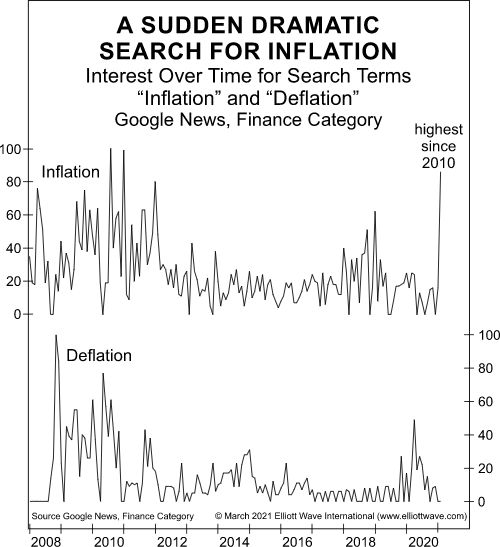

Inflation or Deflation?

|

What the “Sudden, Dramatic” Surge in Googling “Inflation” Tells You It likely “typifies the end of an old economic trend and the beginning of a new one” In the news, you hear that the big monetary fear these days is the prospect for a jump in inflation. Here are some headlines since the start of… Read more Inflation or Deflation? |

Bullish Sentiment Extreme

|

U.S. Stocks: Here’s a Big Sign That “Sentiment Cannot Get Much More Extreme” The stock exposure of the most bearish active investment managers is revealing Relatively few investors want to bet against the stock market rally. As a Feb. 18 financial article says (CNBC): Short interest in the market has fallen to near-record lows. Indeed,… Read more Bullish Sentiment Extreme |

Margin Call Tsunami

|

Why Next Wave of Margin Calls Will Be FAR More “Disruptive” Than in 2000 or 2007 “Can investors afford to borrow anymore?” Financial history shows that every bear market has been followed by a bull market and vice versa. So, the current bull market will end sooner or later. The prior two bull market tops… Read more Margin Call Tsunami |

Why did Bitcoin Crash?

|

Bitcoin’s 24-Hour Crash: FCA Warning Was a Slap in the Face. But It Wasn’t the Cause. See what ‘allowed’ for a turn down in the immediate future. In case you blinked over the last two days, bitcoin bulls had their hat abruptly handed to them when the cryptocurrency plummeted a jarring 26% in 48 hours.… Read more Why did Bitcoin Crash? |