|

Market action this year has hurt A LOT of people. Cryptos. Meme stocks. Tech stocks. We’ve seen some huge percentage declines — all against a backdrop of historic leaps in interest rates and inflation. Lifestyles irrevocably changed, not for the better. Economists missed it. The Fed missed it. Politicians missed it. But a few folks… Read more How to Navigate a Bear Market |

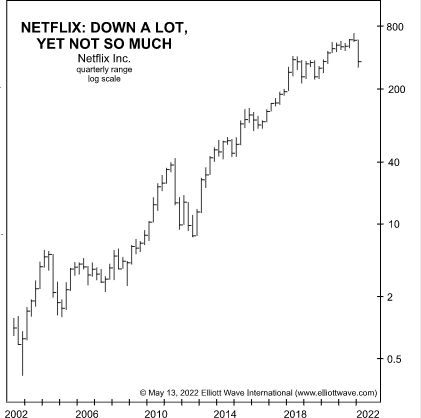

NETFLIX Decline is Only the Beginning

|

Netflix: Way More Room to Drop “Doubled eleven times in 19 years … then cut in half twice” The glory days of at least one of the FAANG stocks appear to be all but over — at least for now. As revenue shrinks at Netflix, more heads have rolled at the subscription-based streaming service of… Read more NETFLIX Decline is Only the Beginning |

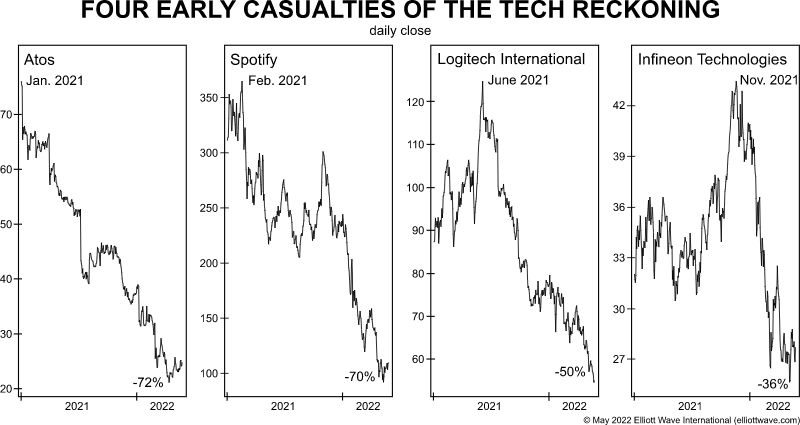

Tech Stocks and the Dot-com “Echo”

|

“Downside surprises should become the norm” The Wave Principle’s basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves, as illustrated in both bull and bear markets below: You probably recall the bursting of the dot-com bubble when the tech-heavy Nasdaq 100 plummeted 78% between March 2000 and… Read more Tech Stocks and the Dot-com “Echo” |

J.P. Morgan Hurricane Warning

|

Economic “Hurricane”: Here’s a Take on a Bank CEO’s Warning Here’s what reached a nadir as the war in Ukraine broke out On June 1, a CNBC headline said: [Major bank CEO] says ‘brace yourself’ for an economic hurricane caused by the Fed and Ukraine war Yes, the U.S. central bank is engaging in so-called… Read more J.P. Morgan Hurricane Warning |

Stock Market is the Leading Indicator

|

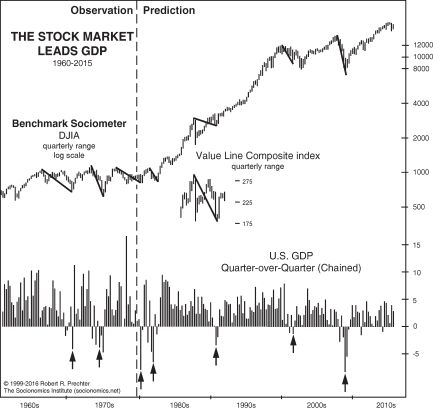

Why the Timing of the Next Economic Slump May Surprise — Big Time “The stock market leads GDP,” not the other way around Do you recall how many government officials, economists or bankers anticipated the severity of the “Great Recession” before late 2007 into 2009? Do you recall even one? If a name doesn’t come… Read more Stock Market is the Leading Indicator |

Scary Part Just Ahead

|

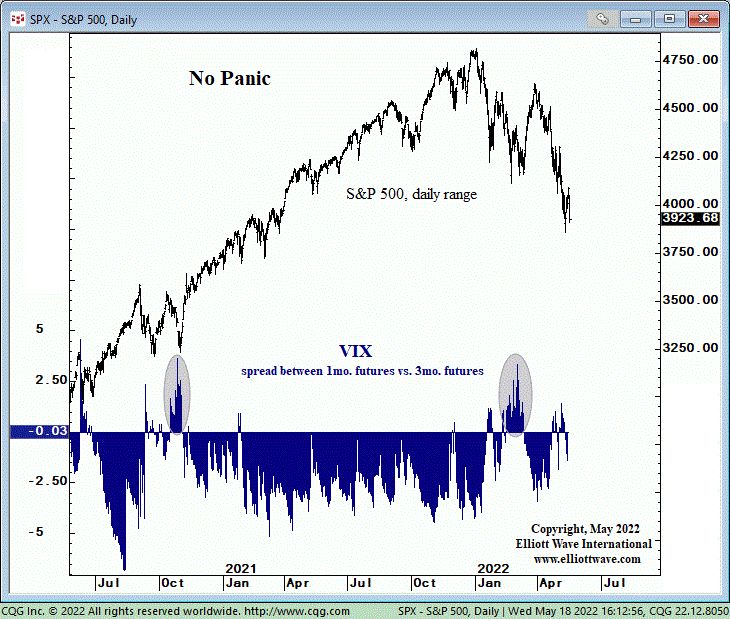

Stocks: Is the Really Scary Part Just Ahead? Here’s one of the actions which investors take when they get “rattled” Big daily selloffs have occurred since the stock market’s downtrend began in January. For instance, on May 18, the Dow Industrials closed lower by 1,161 points — a 3.6% drop. The S&P 500 shed 4%… Read more Scary Part Just Ahead |

The Reversal in Interest Rates

|

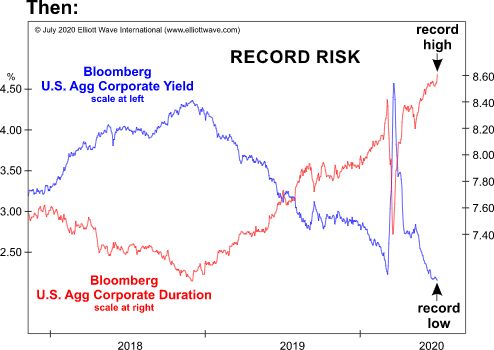

Interest Rates: The Warning That Few Wanted to Heed Here’s an update on this “hugely dangerous bet” Back in mid-2020, a common sentiment toward interest rates was that they would stay historically low for the foreseeable future. Indeed, in July of that year, no less than the Bank of Canada governor said (BNN Bloomberg): ‘Interest… Read more The Reversal in Interest Rates |

Are Stocks Overvalued?

|

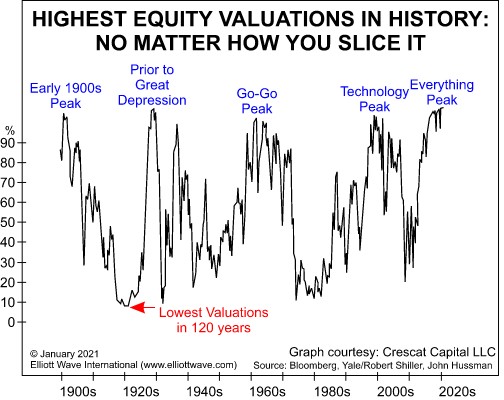

Are stocks overvalued? A quick look at the long term perspective. Take a minute and look at a valuation chart for the stock market: What we have here on the X axis is the bond yield/stock yield ratio for the S&P 400 companies. Sounds fancy, but all it means is that the further you go… Read more Are Stocks Overvalued? |

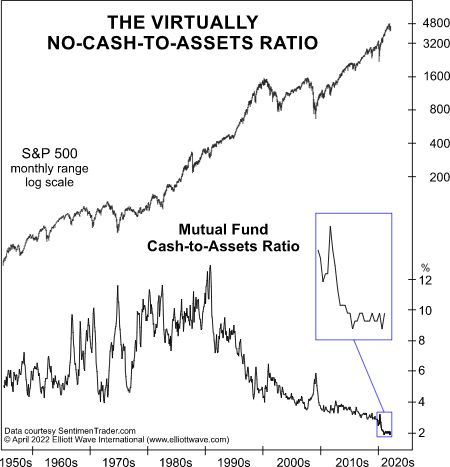

Most Funds Ill Prepared for Bear Market

|

Why Most Equity Mutual Funds Are (Again) Ill-Prepared for a Bear Market Professional money managers herd “right along with other speculators” Is a bear market already underway in the U.S.? Only time will tell for sure. What is known is that the Dow Industrials and S&P 500 index topped in January and the NASDAQ registered… Read more Most Funds Ill Prepared for Bear Market |

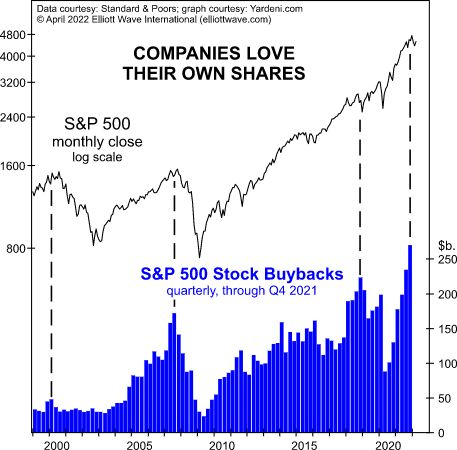

Stock Buybacks Peak at the Top

|

Peaking stock buybacks is consistent with the early stage of a long bear market. Intraday on April 27, the S&P 500 is trading 12.10% lower than it was at the start of the year. Right — not a huge setback — but negative nonetheless. Of course, it’s always possible that this is just the start… Read more Stock Buybacks Peak at the Top |

Why Is the Stock Market Falling?

|

“Why Is the Stock Market Falling?” — (Not Because of These Reasons) Financial journalists almost always mention “reasons” for a given day’s market action. For example, on April 22, an intraday Marketwatch headline gave two reasons for that day’s plummeting prices: Why is the stock market falling? Dow drops over 500 points as investors weigh… Read more Why Is the Stock Market Falling? |

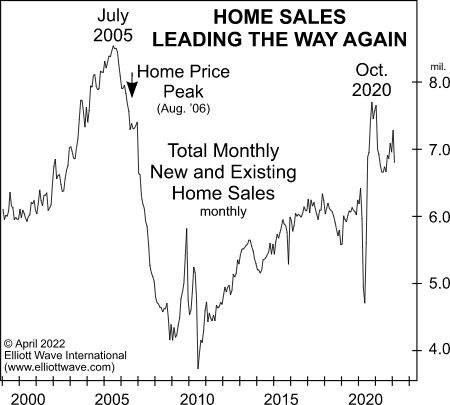

Why US Housing Market is Set to Decline

|

Pending home sales provide a reminder of 2005-2006 Most everyone knows that the housing market has been booming in the U.S. However, if history is a guide, expect U.S. home prices to significantly decline. Why? Well, pending home sales have slowed. And the trend in home sales tends to lead the trend in home prices.… Read more Why US Housing Market is Set to Decline |

NFTs and Tulip Mania

|

Non-Fungible Tokens (NFTs): A Replay of Holland’s “Tulip Mania”? The NFT Index is down more than 55% from its November high. It seems the financial world has gone a little crazy — maybe a lot crazy. Specifically, I’m talking about non-fungible tokens or NFTs for short. You may be familiar with them, but in case… Read more NFTs and Tulip Mania |

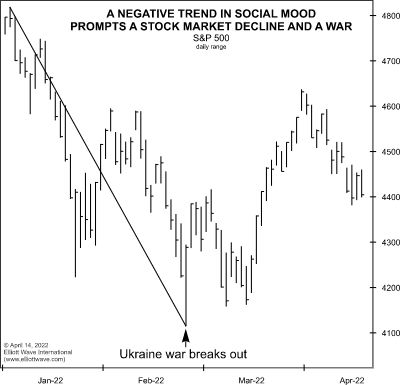

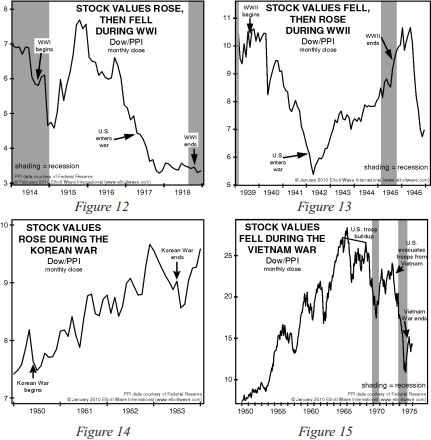

Is War Negative for Stocks?

|

Here’s what really drives the trends of global stock markets Let’s first state the obvious: war is tragic as it brings death and destruction. But does war make the stock market go down? Many observers seem to believe so. Here are some Feb. 22 headlines: U.S. stocks fall sharply as Russia sends troops into breakaway… Read more Is War Negative for Stocks? |

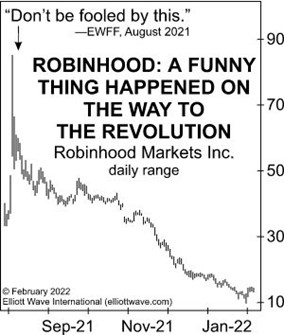

Don’t be fooled by this

|

“Shooting Stars” of the Stock Market: “Don’t Be Fooled by This” A meme stock has been defined as “the shares of a company that have gained a cult-like following online and through social media platforms.” This “following” is largely comprised of novice investors who hope to make a quick profit. You may remember two well-publicized… Read more Don’t be fooled by this |

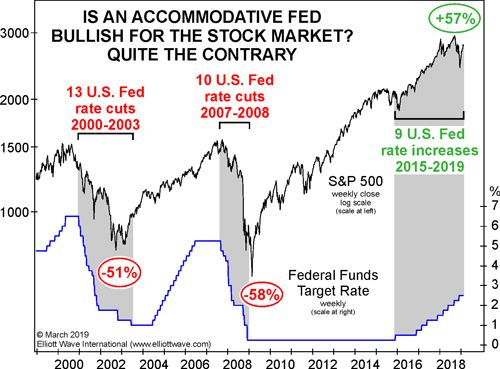

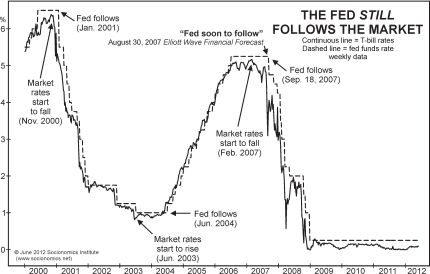

Does the FED Determine the Trend of Interest Rates?

|

Here’s what “leads” the effective federal funds rate Forbes magazine summed up the Fed’s January statement this way (Jan. 26): The federal funds rate remains on hold at zero to 0.25% for now, bond purchases should end in March — and then it’s time to raise rates. The speculation on Wall Street is that the… Read more Does the FED Determine the Trend of Interest Rates? |

Investment Roadmap for 2022

|

Cryptos competing with USD and EUR. NFTs competing with Rembrandt and Da Vinci. Electric car makers with $0 revenue but market cap bigger than GM, Ford or Toyota. How do you make sense of today’s financial trends? Answer: Use Elliott waves to clarify the global macro environment, ID new opportunities and protect your existing investments. In this FREE, big-picture video from our friends… Read more Investment Roadmap for 2022 |

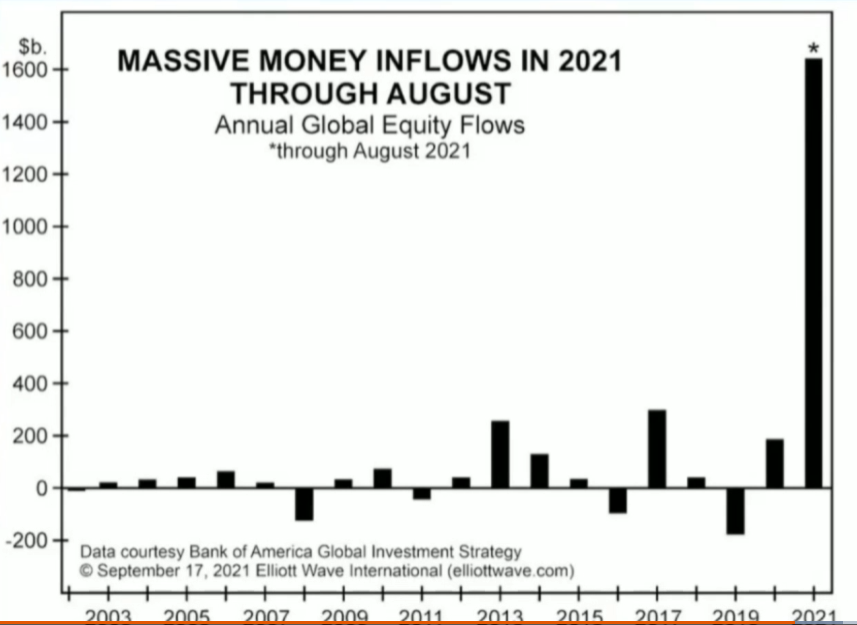

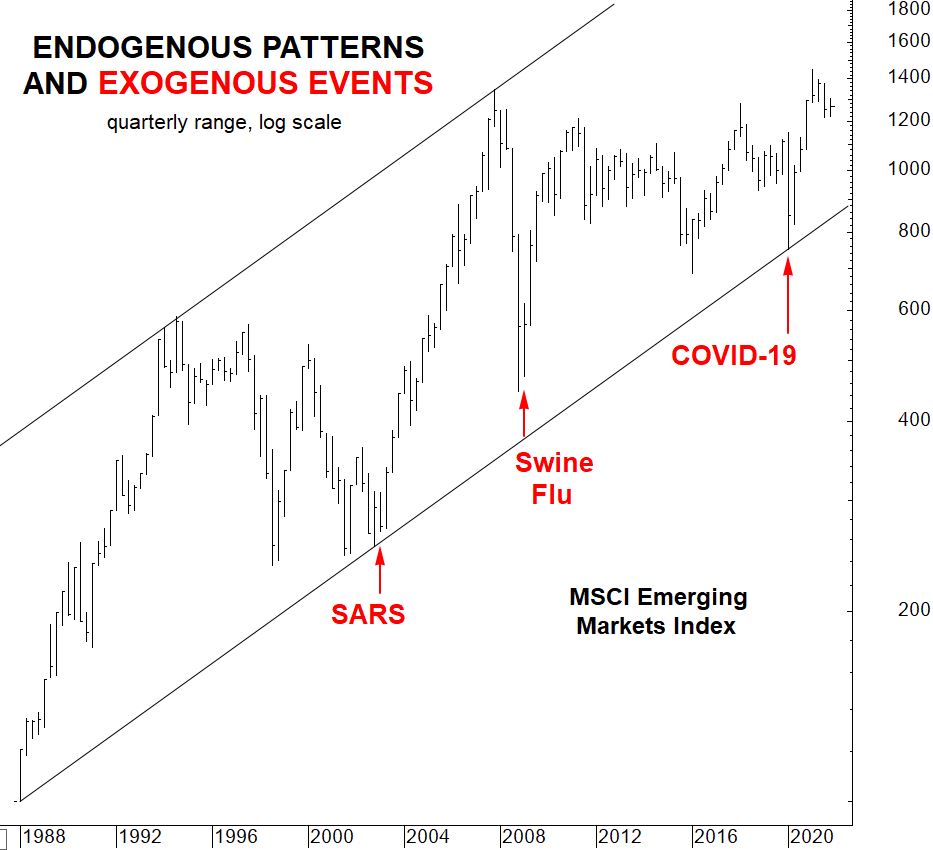

Was Covid a Bullish Event?

|

How to Outwit 99% of Investment Pros Was COVID-19 a “bullish event”? No. Here’s the real answer why stocks rose as the pandemic raged. Waves of social mood fluctuate in accordance with the Wave Principle and determine prices in financial markets. Moreover, these same waves regulate the tenor and character of social attitudes and actions.… Read more Was Covid a Bullish Event? |

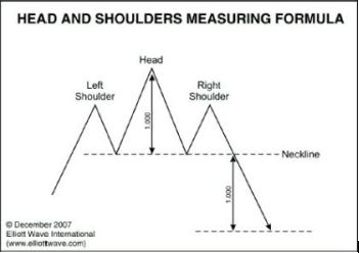

Head and Shoulders in Euro

|

Euro: Look at This Head & Shoulders Chart Formation Learn about the “head and shoulders” measuring formula You are probably familiar with the classic “head and shoulders” chart pattern. But, in case you need a refresher, here’s a brief description of a head and shoulders top: The high of an initial upward move is the… Read more Head and Shoulders in Euro |

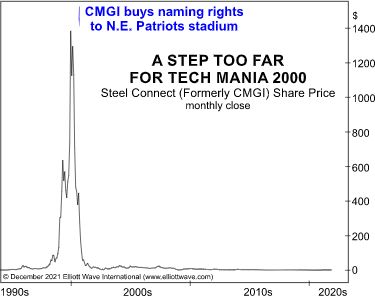

Kiss of Death for Crypto?

|

Has Crypto-Mania Finally Run Its Course? Here’s a high-profile parallel between tech- and crypto-mania When a company that’s part of a major financial trend buys the naming rights to a professional sports stadium or arena, watch out! History suggests that such a prominent move might be a sign that the fortunes of that company are… Read more Kiss of Death for Crypto? |