|

Advance warnings about the recent crypto crash were there all along. How did almost everyone miss them? Anyone on Planet Earth in 2021 knows about the rise and fall of digital currencies. Even many kids are aware. But what has baffled just about everyone is what’s BEHIND the moves. This was made especially clear by… Read more Bull Market Coverage is Bearish |

Category: Stock Market

Articles about stock market, market timing, technical indicators, stock market trends, market top, market bottom.

The Peak in World Stocks

|

“Wall Street never changes,” said Jesse Livermore, the legendary ‘boy plunger’ trader. “The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes.” Livermore’s trading life started towards the end of the 1800s, just as Charles Dow was writing about the stock market in his Wall Street Journal. Dow’s… Read more The Peak in World Stocks |

Russell Index and the Meme Stocks

|

Why This Stock Market Index May Be Headed for a “Bumpy Ride” On Friday, June 25, the Russell indexes underwent their annual rebalancing. In other words, stocks were moved from the Russell indexes like the Russell 2000 and Russell 1000 based on their size. This event usually coincides with a big jump in trading volume… Read more Russell Index and the Meme Stocks |

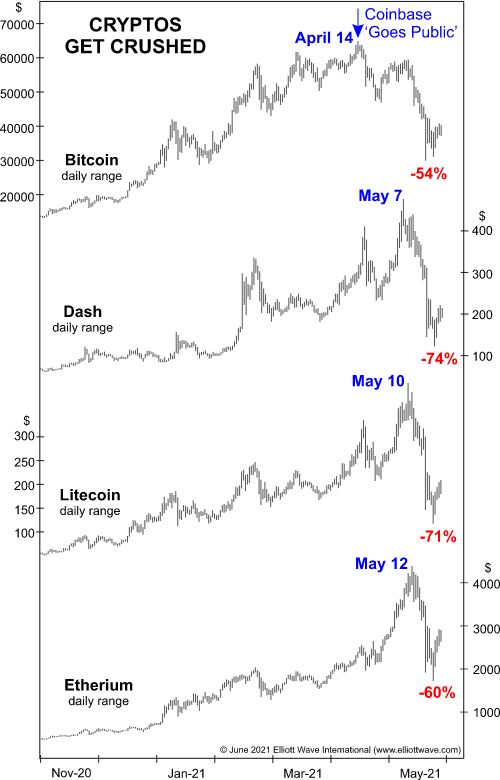

Crowded Crypto Trade Ending Badly

|

Bitcoin: “Crowded Trades” Can End Badly. Here’s How to Spot One. Cryptos can hugely reward, yet just as swiftly — punish. The phrase “bank run” tends to conjure up images of the 1930’s Great Depression. However, that phrase is now applicable to the 2021 world of cryptos. This is from a June 17 coindesk.com article:… Read more Crowded Crypto Trade Ending Badly |

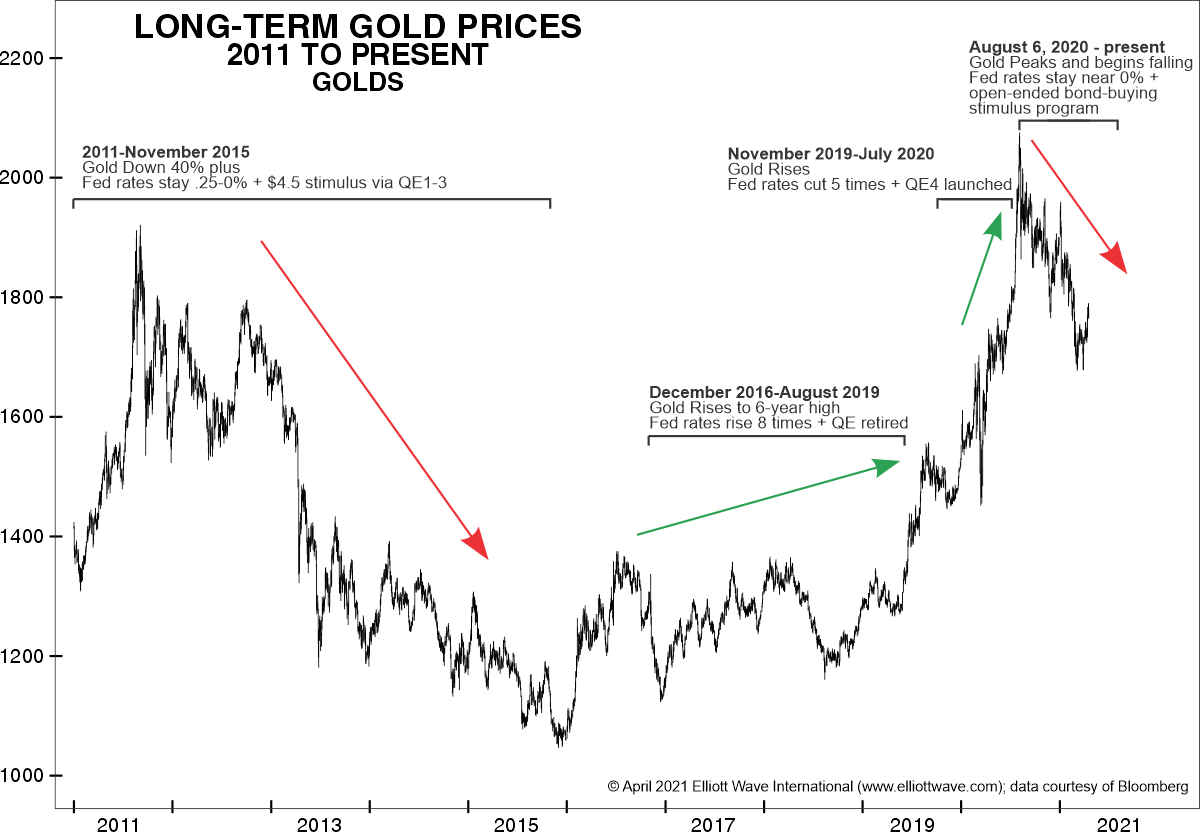

Does Gold Go Up Due to Money Printing?

|

What Drives Gold Prices? (Don’t Say “the Fed!”) Excerpted from Elliott Wave International’s new FREE report ” Gold Investor’s Survival Guide: 5 Principles That Help You Stay Ahead of Price Turns.” There is a glaring hole in the popular understanding of what drives gold’s price. Mainstream finance believes the Federal Reserve’s monetary and interest rate… Read more Does Gold Go Up Due to Money Printing? |

The Margin Doom

|

“Fastest Jump Since 2007”: How Leveraged Investors are Courting “Doom” “Our view is that the use of margin to buy stocks is far higher than the NYSE figures indicate” The stock market uptrend has extended for more than 11 years. Even so, instead of displaying caution, investors have been borrowing to buy stocks like there’s… Read more The Margin Doom |

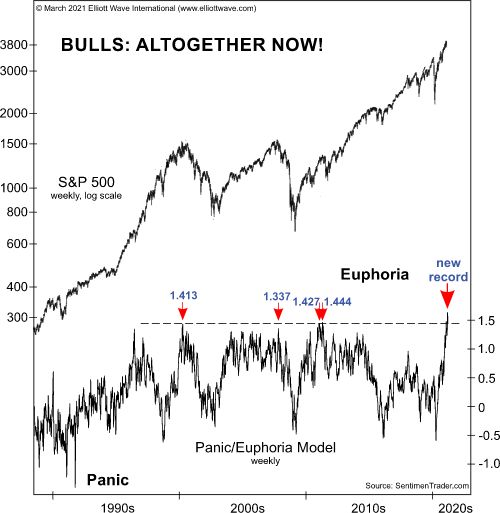

Panic and Euphoria

|

8 Indicators in 1: Here’s the Message of the Panic/Euphoria Mode. Prior model extremes occurred in March 2000 and October 2007. Elliott Wave International has been providing market analysis for more than four decades — which includes many bull/bear market cycles. That said, the public’s current market mindset — especially among inexperienced investors — is… Read more Panic and Euphoria |

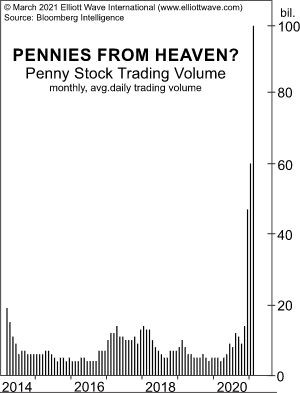

Road to Riches via Penny Stocks?

|

Penny Stocks Hit $2 Trillion Penny stocks are an investment vehicle that really has garnered the attention and speculation of investors in early 2021. They’re plunging headlong into off-exchange shares. I remember back when I started in the early 1980s at Merrill Lynch, there was a guy that walked in the office and he had… Read more Road to Riches via Penny Stocks? |

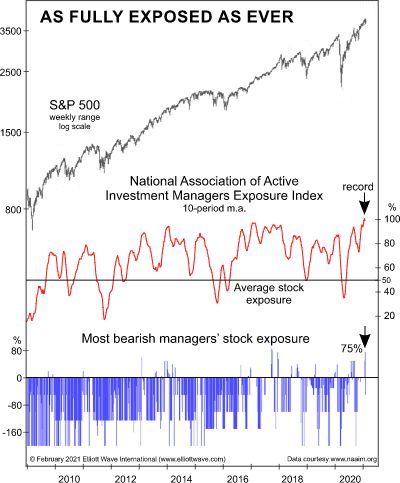

Bullish Sentiment Extreme

|

U.S. Stocks: Here’s a Big Sign That “Sentiment Cannot Get Much More Extreme” The stock exposure of the most bearish active investment managers is revealing Relatively few investors want to bet against the stock market rally. As a Feb. 18 financial article says (CNBC): Short interest in the market has fallen to near-record lows. Indeed,… Read more Bullish Sentiment Extreme |

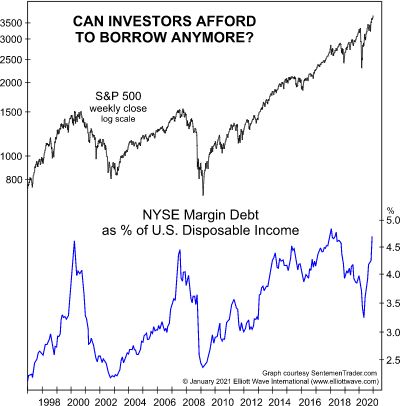

Margin Call Tsunami

|

Why Next Wave of Margin Calls Will Be FAR More “Disruptive” Than in 2000 or 2007 “Can investors afford to borrow anymore?” Financial history shows that every bear market has been followed by a bull market and vice versa. So, the current bull market will end sooner or later. The prior two bull market tops… Read more Margin Call Tsunami |

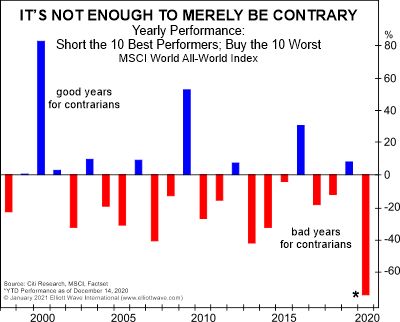

Contrarian Trade Failed in 2020

|

Here’s Why Blind Contrarianism Failed in 2020. There is only one instance when the investing crowd is right. Yes, there are many times when the market’s Elliott wave structure suggests that an investor should take a position “against the crowd,” or put another way, be a contrarian. Prime examples are at market bottoms and tops.… Read more Contrarian Trade Failed in 2020 |

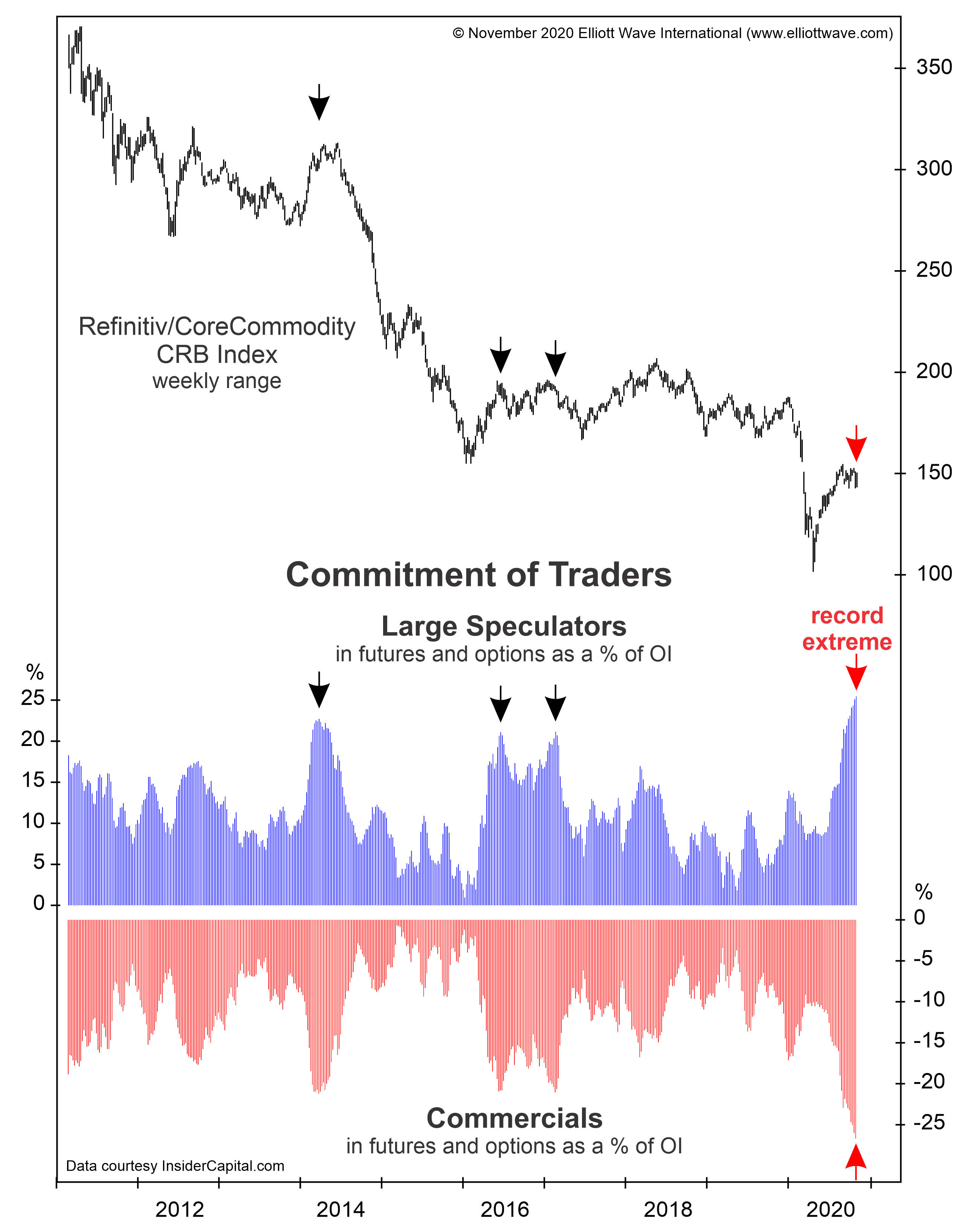

Smart Money vs Dumb Money

|

Small Traders vs. Large Traders vs. Commercials: Who Is Right Most Often? When one of these groups acts, “the odds become high for a change of trend” It’s useful to know who is doing what in particular financial markets. You’ll find out why as we proceed, however, let’s first start off with some basic background… Read more Smart Money vs Dumb Money |

Nobody is Selling Short – Is it a Top?

|

Fear Grips Stock Market Short-Sellers — What to Make of It “This is easily the lowest wager against rising S&P rises” in the history of the data As you may know, short-selling a stock means that a speculator is betting that the price will go down. This is a lot riskier than taking a “long”… Read more Nobody is Selling Short – Is it a Top? |

Gold Fibonacci Retracement

|

Gold: See What This Fibonacci Ratio Says About Trend A Fibonacci .618 retracement is a common reversal point in the markets Fibonacci numbers follow a sequence that begins with 0 and 1, and each subsequent number is the sum of the previous two (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so… Read more Gold Fibonacci Retracement |

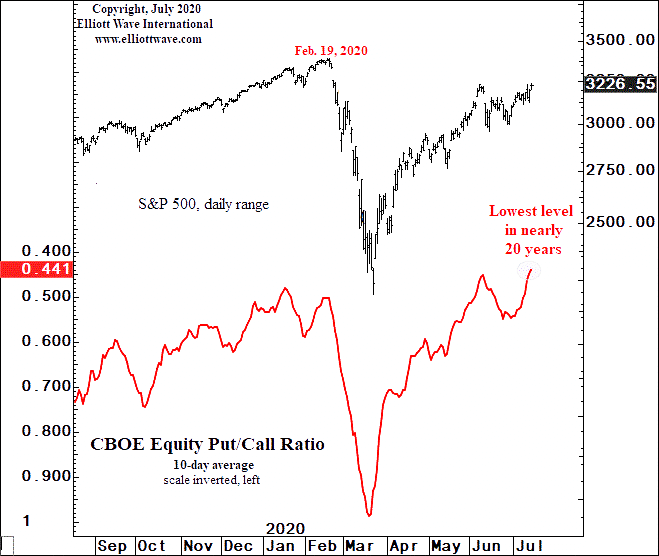

Put/Call Ratio at 20 Year Low

|

This Stock Market Indicator Reaches “Lowest Level in Nearly 20 Years” Here’s what happened “the last time the 10-day put/call ratio made a lower extreme” After a big trend reversal, it’s not unusual for the correction to retrace much of the initial sell-off or rally. Thus, many investors are fooled into believing that the old… Read more Put/Call Ratio at 20 Year Low |

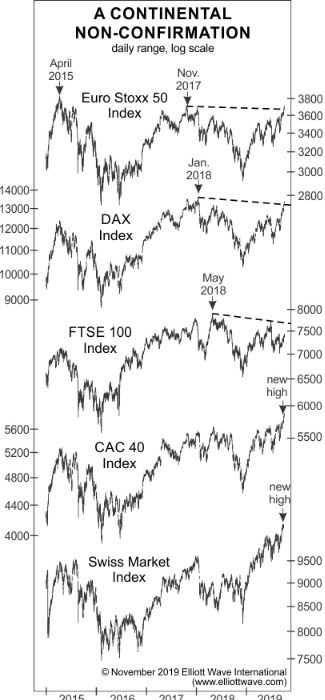

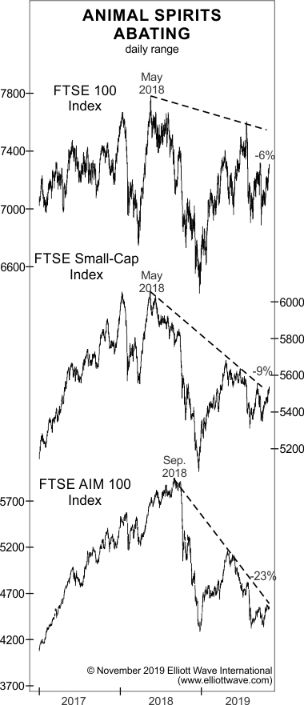

Why Non-Confirmations Matter

|

When a trend is strong, related markets tend to move in unison. However, when a trend is near exhaustion — a bullish or bearish trend, “non-confirmations” often occur. A non-confirmation occurs when one market makes a new high (or low), but a related market does not. As cases in point, our November Global Market Perspective… Read more Why Non-Confirmations Matter |

Is Gold at a Top?

|

Gold and Silver: Pay Attention to This Noteworthy Record High Here’s what usually occurs in related financial markets when “big changes in social mood are afoot” Related financial markets tend to move together. For example, gold and silver. Or, consider stocks. When the Dow Industrials are up on a given trading day, the NASDAQ is… Read more Is Gold at a Top? |

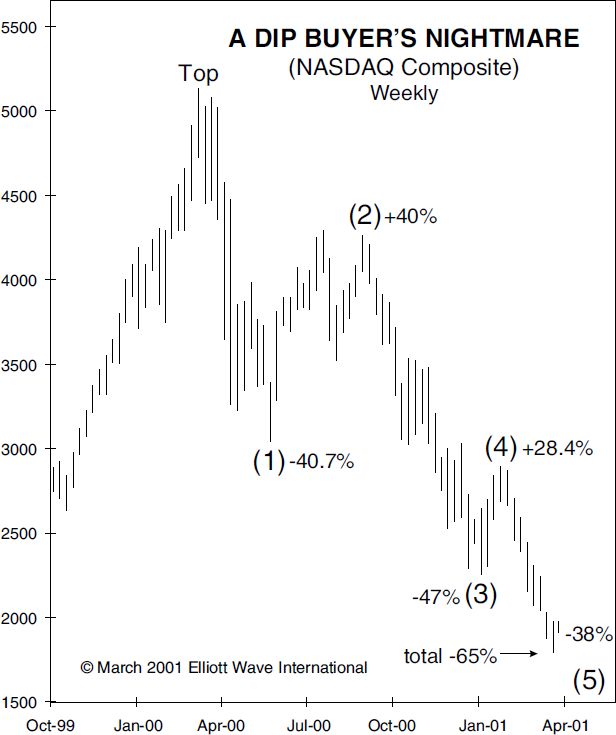

Buying the dip?

|

Stocks: Why “Buying the Dip” is Fraught with Danger Investors know that the main U.S. stock indexes have tumbled very quickly. On a historical basis, some may not realize just how quickly. A March 23 Marketwatch headline referred to a “mind-bending stat”: The S&P 500 has dropped 30% from peak to trough faster than any… Read more Buying the dip? |

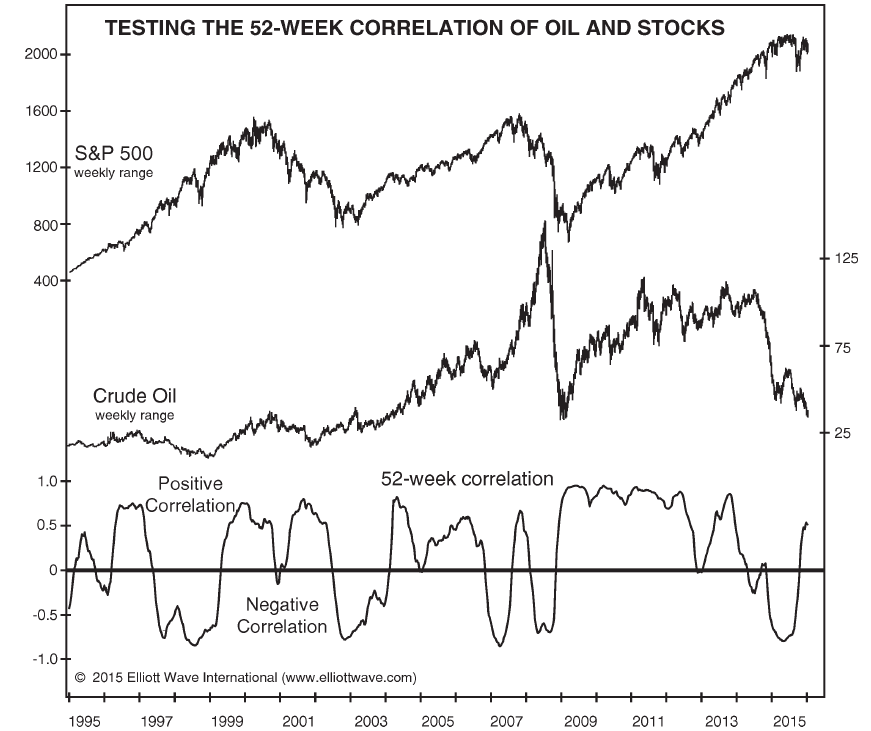

Did the Oil Crash Wreck the Stock Market?

|

Crude oil took a 30% dive on Sunday, March 8. Yet what’s happened in oil this year is so much bigger than that headline-grabbing, one-day move. In January, oil was $64 a barrel. It hit $27.34 intraday on Monday, March 9, so the price of oil fell 57% in just two months. Talk about a… Read more Did the Oil Crash Wreck the Stock Market? |

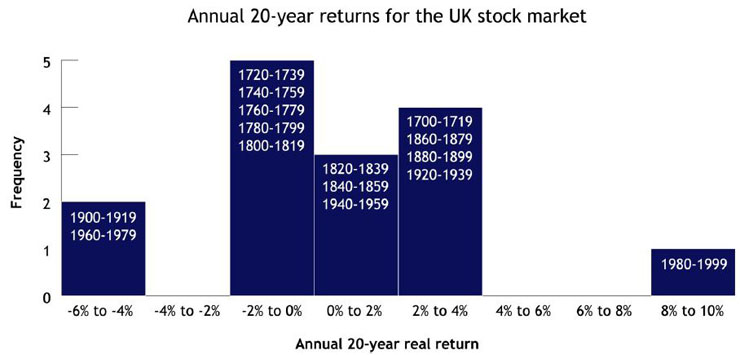

A Long Term Look At the Stock Market

|

Is Outsized Stock Returns the Norm? Below is a chart that shows the historic returns, adjusted for inflation, for the UK market for the last 200 years. It speaks for itself. It looks like a bell curve which shows the highest probable return for the stock market is -2% to +4%. If your 401k is… Read more A Long Term Look At the Stock Market |