|

Fundamental analysis versus Elliott wave analysis: the winner for predicting the 9-year long commodity bear market is clear. 95% of traders fail. It’s a day-drinking, country-music kind of statistic. Think: “Friends in Sell-Low, Buy-High Places.” One article attempts to quantify the reasons, citing: “SCIENTIST DISCOVERED WHY MOST TRADERS LOSE MONEY — 24 SURPRISING STATISTICS.” See… Read more How to Identify the Market Trend |

Category: Stock Market

Articles about stock market, market timing, technical indicators, stock market trends, market top, market bottom.

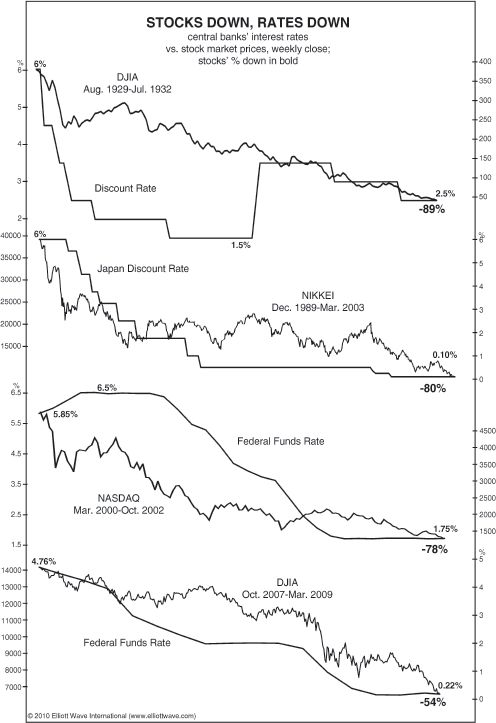

Does Falling FED Rate Mean Higher Stock Prices?

|

Achieving and maintaining success as a stock market investor is a tall order. You, like many others, probably watch financial TV networks, read analysis and talk to fellow investors, trying to understand what’s next for the stock market. One popular stock market “indicator” is interest rates. Mainstream analysts parse every word from the Fed, hoping… Read more Does Falling FED Rate Mean Higher Stock Prices? |

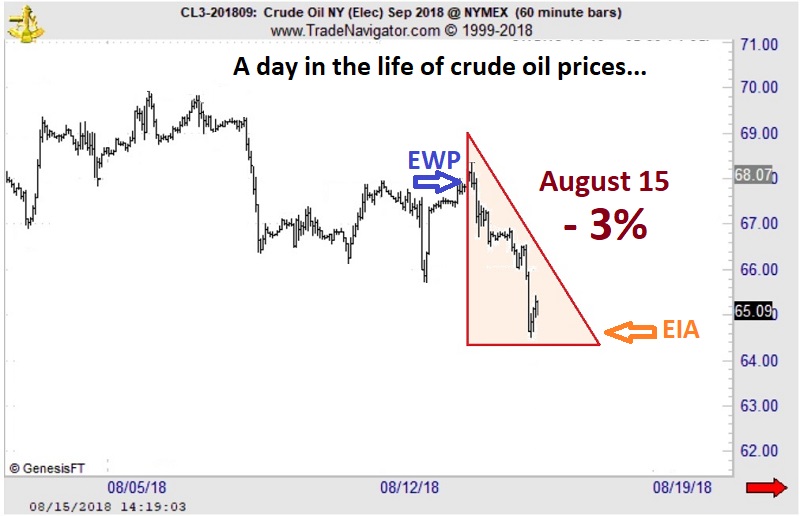

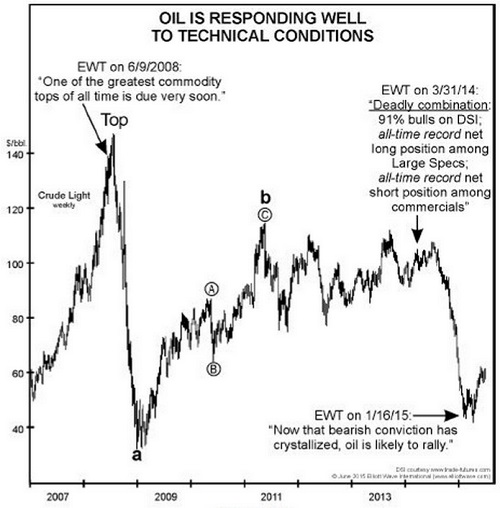

Why Oil Prices Fell

|

Why Oil Prices Fell — Stockpiles or Price Pattern? You be the judge… Let’s cut right to the chart below. The shaded triangle highlights the dramatic price action in crude oil prices on August 15, when crude plummeted 3% to its lowest level in over nine weeks. Now, according to the mainstream experts, the number… Read more Why Oil Prices Fell |

Is S&P 500 Over or Under Valued?

|

3 Videos + 8 Charts = Opportunities You Need to See. Join this free event hosted by Elliott Wave International and you’ll get a clear picture of what’s next in a variety of U.S. markets. After seeing these videos and charts you will be ready to jump on opportunities and sidestep risks in some… Read more Is S&P 500 Over or Under Valued? |

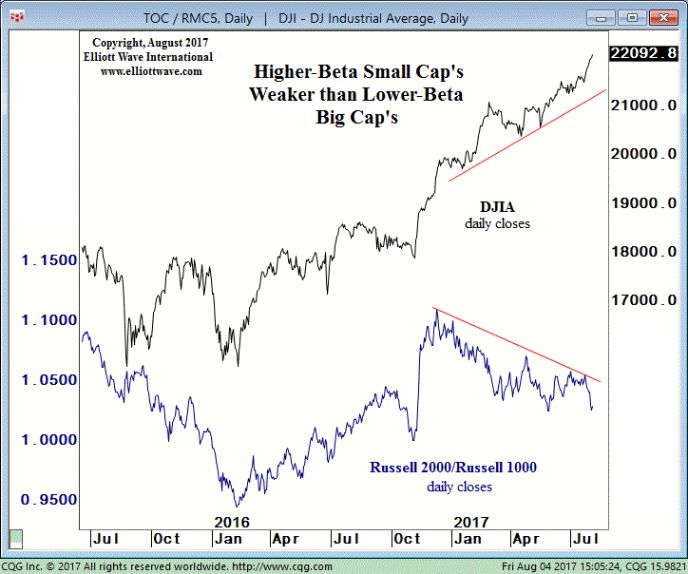

Divergence Between Big Cap and Small Cap Stocks

|

See what happens when speculative fever cools down The market itself provides its own clues about its future price action. One such clue is found in higher-beta small cap stocks vs. lower-beta blue chips. Get our take. Every bull and bear market has a beginning and an end. That would seem to be an… Read more Divergence Between Big Cap and Small Cap Stocks |

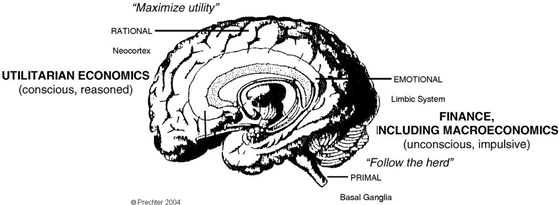

How To Beat Herding Impulse in the Financial Markets

|

We all love a bargain… …Except when it comes to stocks. The reason boils down to uncertainty. We know what our fruits and vegetables should cost at the grocer’s — but we’re far less certain about how much to pay for a blue-chip stock or shares in an S&P 500 Index fund. So how does… Read more How To Beat Herding Impulse in the Financial Markets |

Bond Price Chart Completes Elliott Wave Pattern

|

Recall This Bond Trader Chart? Here’s What Happened Our three recent Treasury Bond charts combine to show you trader sentiment, price action and important near-term turns and trends. Learn the Why, What and How of Elliott Wave AnalysisWatch the Elliott Wave Crash Course, FREE This three-video series demolishes the widely held notion that news… Read more Bond Price Chart Completes Elliott Wave Pattern |

Investors Should Expect the Unexpected

|

Why Stock Market Investors Should Expect the Unexpected Read our forecast for a market rally in the wake of Brexit Investors who jump on “sure things” in the stock market usually lick their wounds with regret. The decision of British voters to leave the European Union appeared to represent low-hanging fruit to short sellers. After… Read more Investors Should Expect the Unexpected |

Is There a Tech Bubble?

|

Silicon valley was not hit as hard during the financial crisis and the tech stocks have done well since. Nasdaq has reached all time high exceeding 2000 bubble levels, retreated a bit. Could we argue we are not at bubble levels yet? Was it business as usual for Facebook to pay 19 billion dollars for… Read more Is There a Tech Bubble? |

Bear Markets Move Fast!

|

With today’s market action, I don’t have a lot of time, and I’m sure you don’t either, but I want to drop a quick note before things get too crazy this week. Here’s the deal: This morning, the Dow crashed 1,000 at the open and has since rebounded. China declined 8.5%. Europe and the S&P… Read more Bear Markets Move Fast! |

Stocks Slide Globally

|

Is this the start of a global financial crash? “When the alarm goes off and the dreamers awake, it will be pandemonium in the stock market.” — Bob Prechter, from the just-released Elliott Wave Theorist. You would agree that markets around the world have served investors a lot of surprises lately: Crude oil just fell… Read more Stocks Slide Globally |

Oil Trend Change?

|

There is one solution to staying ahead of oil’s trend changes — Elliott wave analysis! You know the expression “God works in mysterious ways”? Well, according to an August 6 CNBC article, the price action of one financial market — i.e., crude oil — has out-mystified even God himself. Or, rather, the well-heeled star of… Read more Oil Trend Change? |

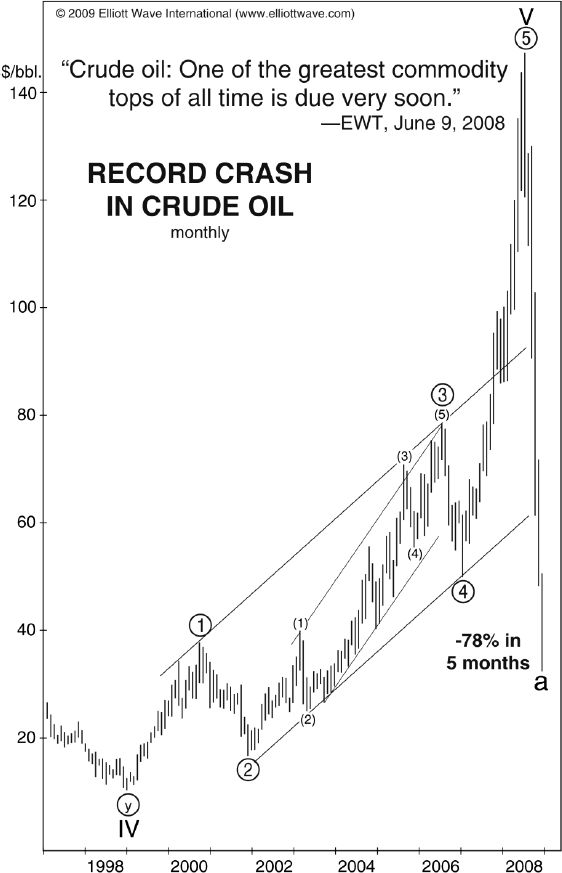

Peak Oil? Oil Price Decline Continues

|

Years ago we used to hear the chatter about how OIL price is going through the roof because either the world is about to reach peak production or has already done so. There was talk of the world running out of OIL and the price would inevitable skyrocket and there was no going back as… Read more Peak Oil? Oil Price Decline Continues |

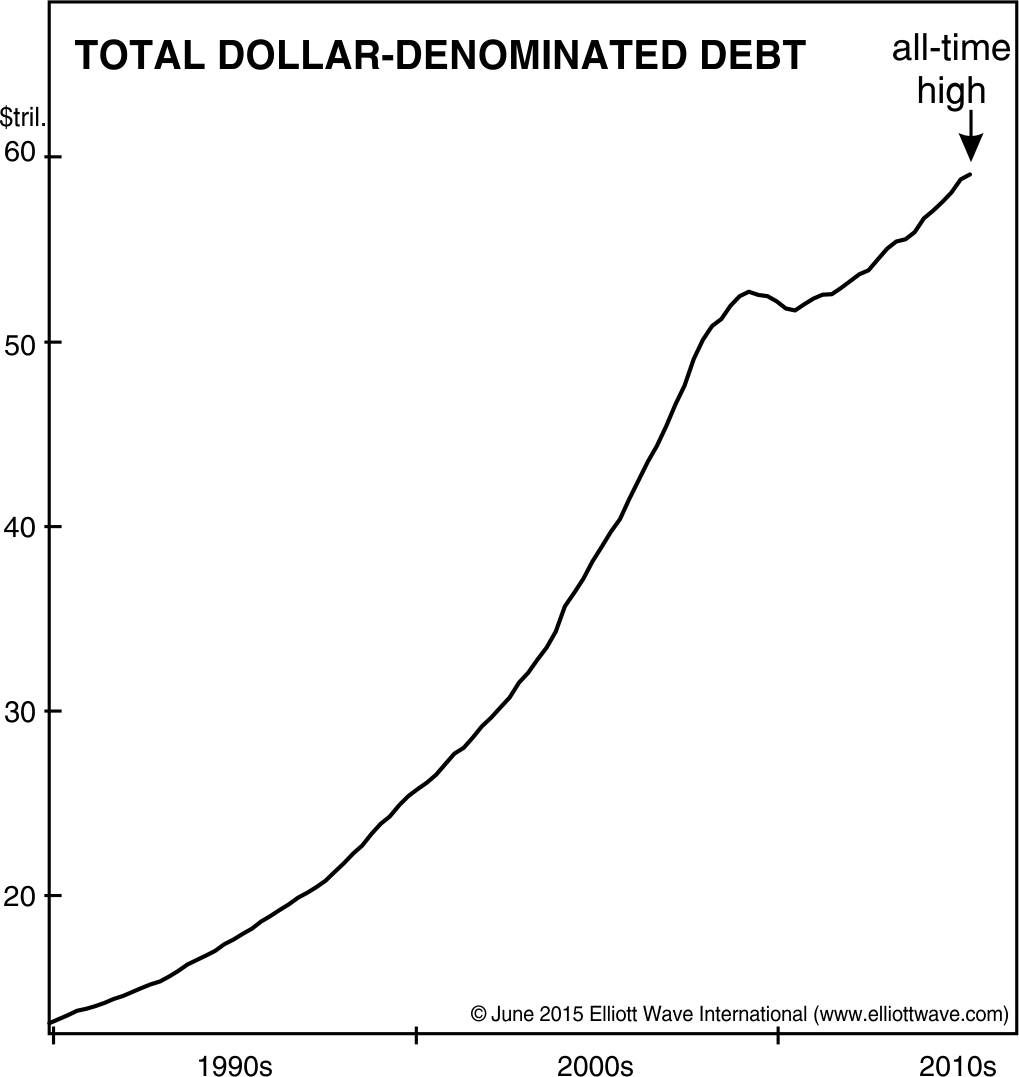

Unprecedented Extremes Indicate Stock Market Bubble

|

After the rally from 2009 stock market bottom, stocks relentlessly marched up often without a breather. We have reported complacency has reached extreme levels in the past. But that in itself does not pinpoint a top. But when we have multiple measures lining up, one has to stop and contemplate the possibility that we are… Read more Unprecedented Extremes Indicate Stock Market Bubble |

Volatility in Chinese Stock Market

|

“Chao gu” is the Chinese term for speculating in stocks. Roughly translated, it means “stir-frying” shares. Lately, though, for millions of Chinese investors, it means getting fried. Enter the “nerve-shredding,” “whiplash-inducing,” rollercoaster “tantrum” of China’s stock market. After soaring to 7-year highs on June 12, both the Shanghai Composite and Shenzhen stock indexes collapsed in… Read more Volatility in Chinese Stock Market |

The New Nasdaq Bubble

|

Most tech stocks lead by Silicon Valley companies had a great run after the 2009 bottom. Nasdaq once again reached above 5000. The Silicon Valley traffic is unbearable, the rents for tech workers are unpayable, housing in the valley challenges prior heights, or already above. Yet the stock market pundits make us believe stock have… Read more The New Nasdaq Bubble |

A Growing Economy is NOT Always Bullish for Stocks

|

A good economy is not necessarily bullish for the stock market! Learn how you can get our FREE, 53-page State of the Global Markets report now >> On Friday (Feb. 27), the 4th quarter U.S. GDP was revised downward to 2.2% from the original 2.6%. “U.S. stock markets shrugged off the revision,” wrote Fox Business.… Read more A Growing Economy is NOT Always Bullish for Stocks |

Why Did the Stock Market Go Down?

|

When the market goes up, or when it goes down, the mainstream media often explains via events or earnings. But very often, the morning headline gets stale by the afternoon on the same day. In the morning it goes something like: XYZ earnings disappoint investors, stocks are crashing! Then by the afternoon they have to… Read more Why Did the Stock Market Go Down? |

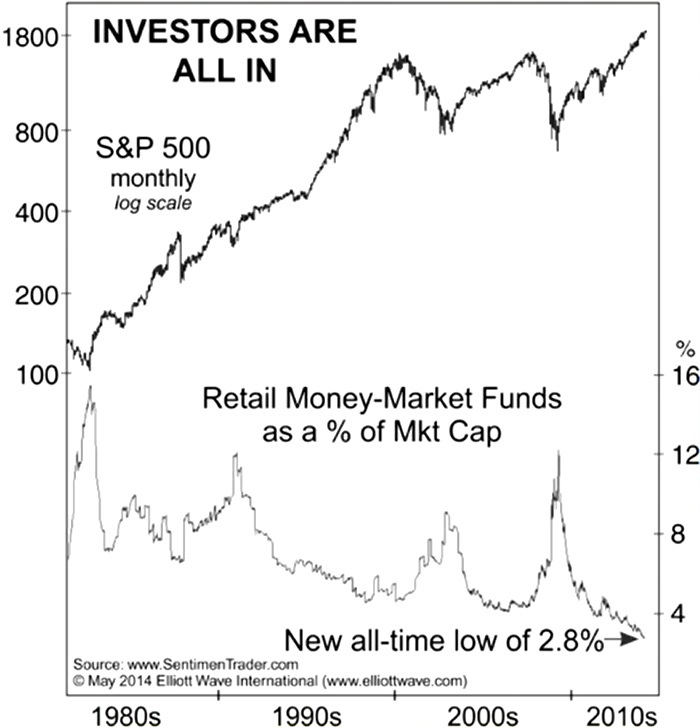

Money Market Funds Signal Reversal For Stocks

|

Stocks Top When Everyone Feels Safe Are the complacent investors heading for another cliff? Steve Hochberg on the state of retail money market funds vs. stock market capitalization, filmed at the 2014 Las Vegas Money Show Editor’s note: The article below is adapted from the transcript of the live presentation above, originally recorded at the… Read more Money Market Funds Signal Reversal For Stocks |

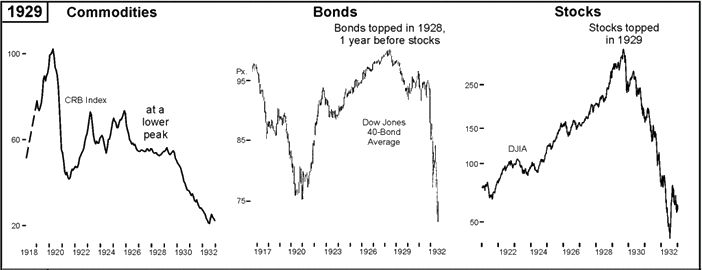

Will Stocks Peak One Year After Bonds?

|

There are financial parallels between the 1920s and today – is history set to repeat? When the financial media mentions the late 1920s, they usually mean the 1929 stock market top and the market crash that followed. But today’s investors can also learn from what happened in 1928. That was the year that the bond market… Read more Will Stocks Peak One Year After Bonds? |