|

Gold is down despite the printing press! Commodities are down! Peak OIL is not the topic anymore. Home prices have moved up with record low cost of lending and tremendous FED help. Stock market defied gravity in 2013 and is holding up so far. But how far can it go? Is the turn near once again? The financial community always… Read more 15 Eye Popping Charts Reveal 2014 Forecast |

Category: Stock Market

Articles about stock market, market timing, technical indicators, stock market trends, market top, market bottom.

Social Mood, Politics and the Stock Market

|

Here is an interesting perspective on predicting the outcome of presidential elections. According to socionomic theory, bear markets come with a downturn in crowd psychology. When the crowd turns from optimism to pessimism, it is first seen in stocks, and then the rest of the economy, politics, culture. A president who is in the office during… Read more Social Mood, Politics and the Stock Market |

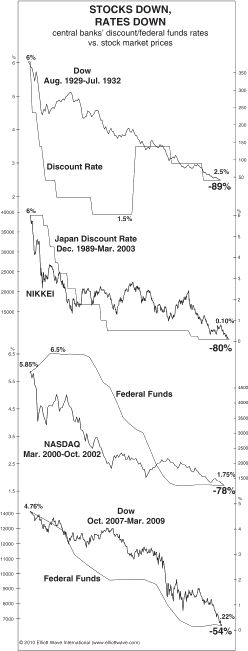

Do Low Interest Rates Move Stocks Higher?

|

Many investors think that the Federal Reserve reduces the interest rates and that makes the stock market move higher. But there are two fallacies in this assumption. For one, the Federal Reserve does not set the interest rates, the market does. FED follows. Below we are going to show you a chart of declining interest… Read more Do Low Interest Rates Move Stocks Higher? |

What moves the stock market?

|

The widespread idea is that events around the world direct the financial markets. We are told to believe that the market reacts to the news and people’s mood changes accordingly. When the news are good, people feel good and they buy stocks they say. When the news are bad, people sell stocks according to the… Read more What moves the stock market? |

Is It a Bear Market Rally?

|

Market had a sharp decline 2 months ago. We are well below 200 day average, and we have bounced off of 38.6% fibonacci retracement level a few times. Price support level has been holding well. Now the sentiment in the mainstream media is that this is a healthy pullback, a buying opportunity in the stock market. One needs to… Read more Is It a Bear Market Rally? |

Prechter Explains ‘Triple Top’ Forming in U.S. Stock Market

|

(Video) Bob Prechter Explains ‘Triple Top’ Forming in U.S. Stock Market This excerpt from the special video issue of the August Elliott Wave Theorist brings you Bob Prechter’s analysis of the triple top that has been forming in the U.S. stock market over the past 12 years. Watch as Bob himself explains what this pattern… Read more Prechter Explains ‘Triple Top’ Forming in U.S. Stock Market |

Once in a Life Time Stock Market Trade

A Reliable Stock Market Indicator

|

The Single Most Reliable Indicator The market is falling and has just broken the neck down in the widely watches head and shoulders pattern. Those who are trading stocks, the savvy ones who prefer stock market timing instead of buy and hold are shorting the stocks. Most people pay attention to the news and events… Read more A Reliable Stock Market Indicator |

Spotting Trade Setups

|

Technical analysis helps in recognizing the markets direction and possible turning points. There is no one-size fits all silver bullet solution to get you ahead of the crowd all the time. By definition, only the few will make money in the stock market. And we can use some tools to enhance the odds in our… Read more Spotting Trade Setups |

What Really Moves the Markets

|

News? The Fed? The Real Answers Will Surprise You Bernanke made his QE2 promise real and started to print money again. Ironically the day of his announcement marked the low in US dollar index and dollar started to rally. Similarly, treasuries and mortgage rates staged their multi week rally after the announcement of QE2. We… Read more What Really Moves the Markets |

Is the Plunge Protection Team Manipulating Stocks?

|

Rumors are, the U.S. government “is propping up the stock market.” By Elliott Wave International Out of thousands of questions recently submitted to us at Elliott Wave International, the most frequent one received is: “Can the Fed manipulate the stock market?” Read our expert’s answer on this and other misleading “investment wisdom.” Read more. You… Read more Is the Plunge Protection Team Manipulating Stocks? |

Slicing the Neckline: A Classic Technical Pattern

|

A Classic Technical Pattern Agrees with the Elliott Wave Count: Slicing the Neckline In the August issue of his Elliott Wave Theorist, market forecaster Robert Prechter alerted readers that the U.S. stock market was slicing the neckline of a classic head-and-shoulders pattern in technical analysis, and that this may send the market into critical condition.… Read more Slicing the Neckline: A Classic Technical Pattern |

Is it time to invest in China and Japan?

|

Chinese GDP growth was more than 10% according to yesterday’s report. China is taking steps to clamp down on credit expansion to avoid an over heating economy. As you likely know, the Asian markets have become an undeniable force in the global economy, and they have provided some of the most exciting investment opportunities in… Read more Is it time to invest in China and Japan? |

Long Bear Market Looming

|

Prechter on CNBC: Market Pro: Long Bear Market Looming Robert Prechter, president of Elliott Wave International, tells host Maria Bartiromo why he sees dark days ahead on CNBC’s Closing Bell. Download Your FREE 50-Page Ultimate Technical Analysis Handbook In this free 50-page eBook from Bob Prechter’s Elliott Wave International, you will discover some of the… Read more Long Bear Market Looming |

Big Bear Markets: More Than Falling Stock Prices

|

By Elliott Wave International Fear and uncertainty that drive a severe bear market are the same emotions which can set the stage for authoritarianism, in most any nation. "Bear markets of sufficient size appear to bring about a desire to slaughter groups of successful people. In 1793-1794, radical Frenchmen guillotined countless members of high society.… Read more Big Bear Markets: More Than Falling Stock Prices |

‘Defensive’ Stocks: Are They the Ticket in a Downturn?

|

By Elliott Wave International Approximately three out of four stocks go down in a bear market. This ratio doesn't just apply to high beta names; historically, 75 percent of all stocks go down when the general market falls. Considering we could be headed into a severe bear market (read Bob Prechter's latest special two-issue Elliott… Read more ‘Defensive’ Stocks: Are They the Ticket in a Downturn? |

What Do These 8 Technical Indicators Mean for the Markets?

|

Editor's Note: The following article is excerpted from Robert Prechter's April 2010 issue of the Elliott Wave Theorist. For a limited time, you can visit Elliott Wave International to download the full 10-page issue, free. By Robert Prechter, CMT Technical Indicators It is rare to have technical indicators all lined up on one side of… Read more What Do These 8 Technical Indicators Mean for the Markets? |

Blaming “Market Manipulators” For Losses is a Huge Obstacle to Success

|

By Editorial Staff In 1984, Elliott Wave International's founder and president Robert Prechter won the U.S. Trading Championship, setting a new all-time profit record of 444.4% in a monitored real-money options account in 4 months. In the average 4-month contest, over 75% of contestants, mostly professionals, fail to report profits. In November 1986, in his… Read more Blaming “Market Manipulators” For Losses is a Huge Obstacle to Success |

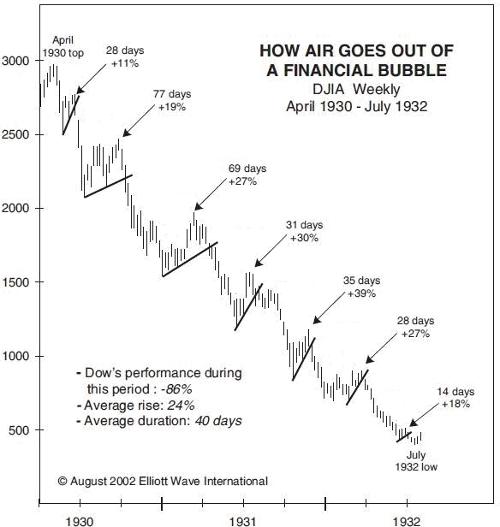

Deflationary Crash?

|

What makes stocks rise? What makes steady Employment? What makes home prices increase? Social mood is what drives the markets, the economy, politics and the culture: http://www.tradingstocks.net/socionomics/ Early in the game when debt levels are down, as the social mood improves in capitalist economies, people start borrowing to create a good future for themselves. They work hard,… Read more Deflationary Crash? |

Market Myths Exposed: Inflation Is Not A Threat, Deflation Is

|

By Nico Isaac Most people are confident they can recognize a myth when they hear one: Wearing a hat causes baldness; eating a bunch of carrots gives you perfect vision; 'light' cigarettes are better for your health than the regular kind. But what about this sentence: Inflation is the number one threat to the US… Read more Market Myths Exposed: Inflation Is Not A Threat, Deflation Is |